That slow grinding creak you hear in the background; that’s the U.S. economic engine running without oil and beginning that slowdown phase just before it stutters and stalls completely. Alas, the pretending continues…

As noted by the Wall Street Journal, an economic gaslighting institution with a central mission to maintain pretenses, “business surveys show U.S. factory activity declined in December, the Institute for Supply Management and S&P Global both said this week. Separately, S&P Global said Thursday that U.S. services-sector businesses reported a decline in output for the third month running in December.” This comes as “U.S. imports dropped more, by 6.4% on the month, as Americans cut back on holiday-related purchases, including items from other countries such as computers and autos.”

As noted by the Wall Street Journal, an economic gaslighting institution with a central mission to maintain pretenses, “business surveys show U.S. factory activity declined in December, the Institute for Supply Management and S&P Global both said this week. Separately, S&P Global said Thursday that U.S. services-sector businesses reported a decline in output for the third month running in December.” This comes as “U.S. imports dropped more, by 6.4% on the month, as Americans cut back on holiday-related purchases, including items from other countries such as computers and autos.”

Keep in mind, November retail sales—which included consumer spending at stores, online and at restaurants—fell 0.6% from the prior month for their biggest decline of 2022, according to the Commerce Department. Manufacturing output declined in November as well, the Fed reported, while U.S. home sales fell for a record 10th straight month.

Into this mix of economic metrics, driven by a collapse in disposable consumer income and high energy prices, now we begin to see the number one business expense being curtailed.

(Market Watch) […] Amazon.com Inc layoffs will affect more than 18,000 employees, the highest reduction tally revealed in the past year at a major technology company as the industry pares back amid economic uncertainty.

The Seattle-based company in November said that it was beginning layoffs among its corporate workforce, with cuts concentrated on its devices business, recruiting and retail operations. At the time, The Wall Street Journal reported the cuts would total about 10,000 people. Thousands of those cuts began last year. (more)

Amazon is not alone, “Vimeo said Wednesday that it will cut its workforce by 11% as part of a broader effort to reduce costs, citing deteriorating economic conditions” (link). Additionally, Salesforce Inc. is laying off 10% of its workforce and reducing its office space in certain markets, extending a brutal period for tech job cuts into the new year.”

We can anticipate more reports like this from Reuters, “Samsung Electronics Co Ltd’s quarterly profit will likely plunge 58% to its lowest in six years as a global economic downturn saps demand for electronic devices and clouds the outlook for the memory chip industry. With consumers and businesses reducing spending and investment in the face of high inflation and climbing interest rates, smartphone makers and other clients held back memory chip orders, while smartphones sold for less as demand suffered, analysts said.”

Electronics, cars, furniture, durable goods of all types and varieties are plummeting in sales. Consumers are being squeezed by inflation, housing, energy and food costs, and spending priorities are being reevaluated yet again. Compare the impact on ‘real wages’ -vs- the 2007/2008 economic crisis.

From a purely fraudulent accounting perspective, however, the drop in U.S. imports will help boost calculations of U.S. economic growth in the fourth quarter because trade deficits subtract from overall output, or gross domestic product.

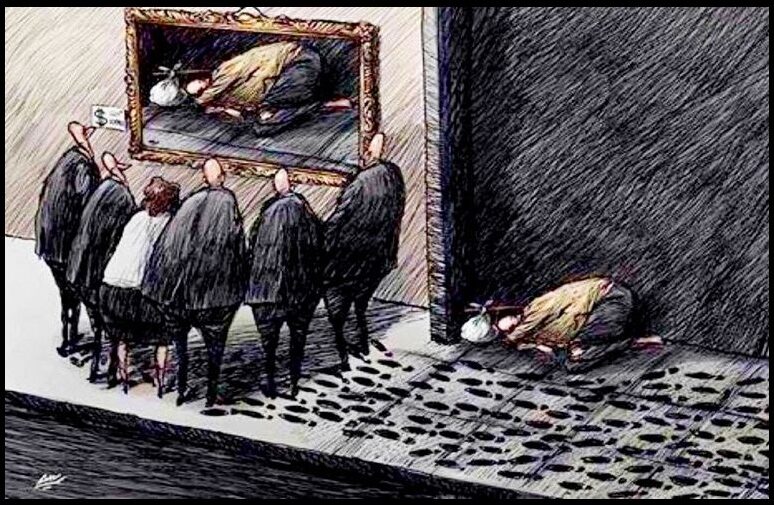

U.S. consumers not purchasing imported goods makes the health of the U.S. economy look less bad; but it’s an illusion akin to smiles in the bread lines.

In other economic news, I did some real estate analysis over the past several days and it’s safe to say there is a steep downward trajectory in the data I use. Again, home values are nuanced on a regional level, but my model is pretty close in averaging.

If buyers do not absorb the seller’s loss in equity (which no one should ever do), in my SWFL area a $450k home listing is going to sell around $380k at the high side (actual value based on economic indicators and buyer ability). That rough estimate, while slightly offset due to general inflation, should trend nationally over the next 12 to 18 months. That means macro home prices dropping around 15 to 20% nationally over the next 12 months.

If you are a home buyer, put your offers around 15 to 20% below current asking price without any emotional attachment to it. Don’t flinch, remain ambivalent and walk away if refused. The recovery to current price will take around a decade. If you are a seller and get an offer within -10% of asking, consider yourself lucky and jump on it.