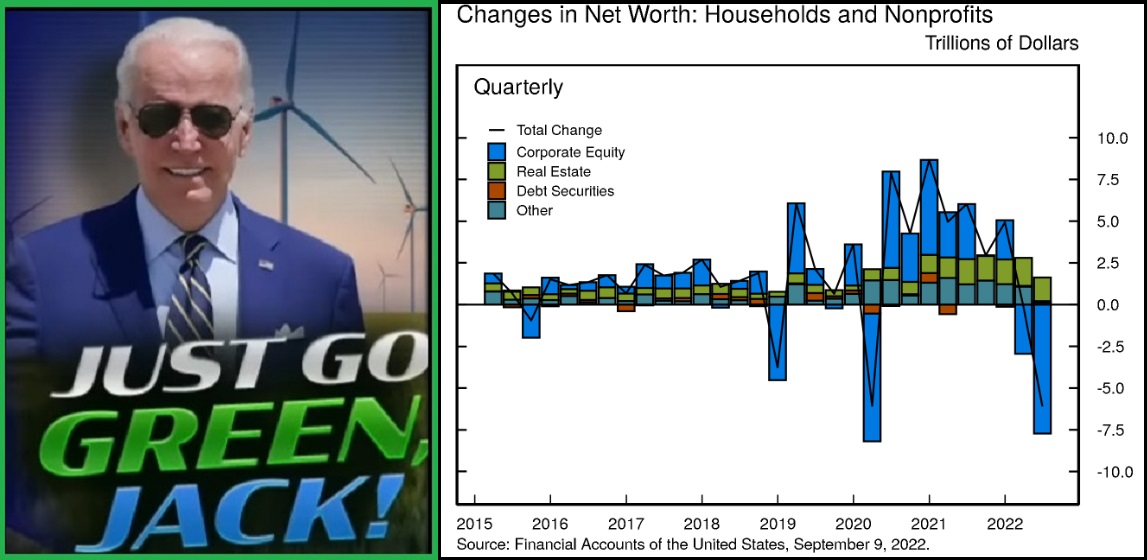

The U.S. Federal Reserve has published the second quarter 2022 balance sheet of U.S. total household wealth [DATA HERE].

In the second quarter (April, May, June) 2022, the total U.S. household wealth dropped $6.1 trillion, despite a calculated increase in home value of $1.5 trillion. The majority of the loss is connected to a drop in Corporate Equity (stock market) and household investment in the stock market.

FED “The net worth of households and nonprofit organizations declined $6.1 trillion to $143.8 trillion in the second quarter. The value of stocks on the household balance sheet declined by $7.7 trillion, while the value of real estate increased by $1.5 trillion.” Keep in mind this is backward looking data, and after a period of decelerating rates of growth, the overall real estate market is now in a period of decline as calculated for the most recent month of July [DATA].

The equity position of homeowners is now considerably less than the equity position when the feds calculated the second quarter household wealth (two months ago). Part of the issue goes back to what we have been discussing with inflation and specifically energy driven increases in fuel and electricity.

Inflation sucks money out of the economy, making people less wealthy. Energy inflation sucks money exponentially faster out of each household, potentially making the already working-class poor, much poorer.

The higher prices paid for housing, food, fuel and energy do not contribute to anything, the increased costs are just sucked out of the consumers’ pockets without generating any additional value. It just costs more to live, and that reduces wealth. Consider this the cost of going green.

Joe Biden and his economic team are introducing phrases like “a growth recession,” to explain a dynamic where earned wages are replaced by government subsidy. You can no longer afford food, energy, housing etc, so the government steps in as the provider of subsidy based on income level to supplement the gap between wages and the new costs of products and services within the Biden created “green” economy.

However, in the bigger of big pictures, the government does not create wealth. Wealth is created outside government by private activity. Government income via taxation is lowered when the economic activity of the private sector drops.

There is currently a massive lag in recording dropped economic activity that is going to surface very soon. The rate of energy price increase has been so large, so fast, the ability of producers to transfer the cost creates an economic lag.

Total product costs (except imports) are rising faster than finished good prices to consumers. At the same time, consumer demand for goods has dropped dramatically due to the speed and rate of increased energy costs. As a combined result, the equity market will likely continue to decline as each earnings report comes in lower than prior expectation.

Now, looking at wealth over time, what happens to the economic model of Biden when current housing value ($41.2 trillion) simply drops back to 2020 levels ($33.0 trillion a conservative real estate market correction)?

Continued higher prices to consumers, less money to government, less economic activity and lower household equity. That’s trouble, big trouble.

Wave #3 of food inflation starts hitting hard next month as the increased costs at the field start to transfer through the supply chain from harvest to the fork.

WASHINGTON DC – […] The sour mood appears to stem from record food, energy and housing prices. Positive views of the grocery industry dropped 14 percentage points from last year, the biggest drop in the survey. The real estate industry dipped 9 points, the second-largest decline.

Just 22 percent of respondents reported having a positive view of the oil and gas industry, down from 28 percent last year. Twenty-nine percent reported having a positive view of electric and gas utilities, down from 36 percent last year.

Grocery prices rose a stunning 13.1 percent over the last 12 months ending in July, the largest annual increase in more than four decades, according to Labor Department data.

Housing affordability has fallen to its lowest level since the Great Recession, according to the National Association of Home Builders, with rents and home prices at record levels.

Gas prices reached an all-time high in June before falling slightly in recent months, while energy bills are also soaring amid huge demand for natural gas. (read more)

Meanwhile Biden’s economic team is bragging that Main Street is in better shape?

“The President’s first two years in office have been two of the most productive in American history, and as the Blueprint explains, these accomplishments are all part of one economic vision.” (more)