This is epic. This is like listening to Grandpa rail against the Federal Reserve and central banks without realizing the motive behind what the Federal Reserve and central banks are doing. This is the best example of the misconception behind ‘The Great Pretending,’ to date.

U of Penn, Wharton Business School professor of finance, Jeremy Siegel, rails against Jerome Powell and the central bankers for raising interest rates into a collapsing western global economy. Everything, everything he outlines, is essentially accurate about the damage being done to western economies. …. Except the biggest realization and acceptance is missing…. It’s being done by design. The people he outlines are not making a mistake, they are doing it on purpose. First, WATCH:

The U.S, EU, CA, AU and western economic central bankers did not respond sooner to the inflation crisis (2021) because the central banks were waiting for the politicians in their systems to establish the energy policy that their pre-planned action was intended to support. [<- Reread that if needed].

Once the collective Build Back Better/Climate Change energy policy was established (2021), and after the resulting inflation created the justification for the central bank action, then -and only then- did the central bankers trigger the next phase of raising interest rates (2022) to reduce western economic activity and support the Build Back Better agenda.

All of this was by design. None of this was by mistake. The process, strategy and timing were all part of the Build Back Better agenda. Purposefully created inflation, the result of the energy policy, was planned and used by the central banks to justify the rate increases. It was a self-fulfilling prophecy built into the Build Back Better roadmap.

Now these ‘bankers’ are trying to collapse the economy to meet the reduction in energy production. The bankers are supporting the political motives of the politicians. This is all intentional. Jeremy Siegel misses this core and fundamental aspect. However, some of the lesser ideological western leaders (politicians) are starting to get ‘cold feet.’

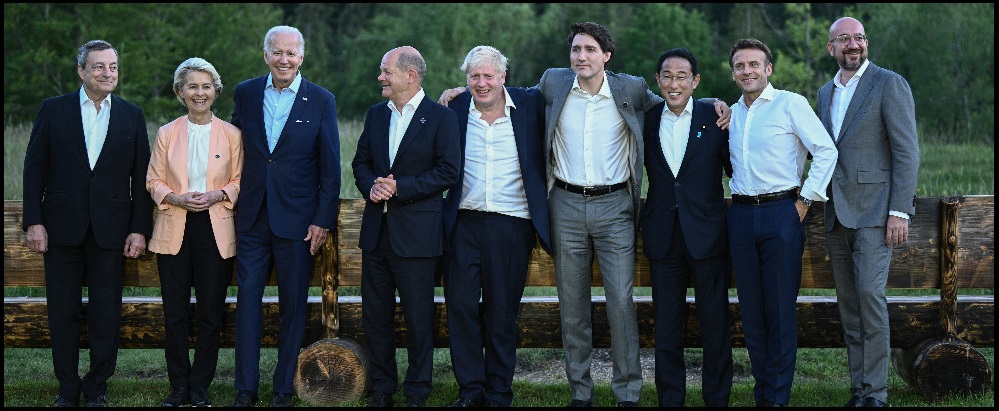

The U.S, EU, Canada and Australia/New Zealand are ‘all-in.’ Joe Biden (U.S.), Justin Trudeau (CA), Jacinda Ardern (NZ) and Ursula von der Leyen (EU) are unwavering and all in. All of their central bank control officers are also all-in, including Christine Legarde (EU). These unflinching ideologues are not going to budge, but some of the politicians within their economic systems are starting to get cold feet.

Japanese Prime Minister Fumio Kishida was the first to express reservations about the collective goal to sink their economy. German Chancellor Olaf Schultz is also realizing he may not survive unless he cuts the cord tying him to the Build Back Better anchor of un-survivable renewable energy policy. The recently installed British Prime Minister Liz Truss is also trying to untangle the knot tied by Boris Johnson, as her nation now suffers with double digit energy price increases. These are the first fractures in the coalition since the Build Back Better agreement was made.

Jeremy Siegel is correct as to the outcome, but he -like almost all western financial pundits- are blind to the true motive. Siegel is blaming it on incompetence, instead of going back to the original Build Back Better design as openly expressed by the central banks and politicians in 2020. They were not hiding it.

The collective western leadership openly said this exact scenario was what they were going to do coming out of the useful COVID-19 pandemic.

The Western leaders openly stated they were going to use the time of lowered economic activity (created by the pandemic) as a gauge to measure and deploy a permanent change to the global system of energy development. They were going to exit the pandemic with a new focus on climate change and new energy systems.

That pandemic “exit” was the gateway into the “economic transition” that all of the western leaders then began describing.

Throughout 2021 traditional oil, coal and natural gas exploitation was reduced by policy. Inflation skyrocketed while the central bankers waited like kids playing double-dutch jump rope. Wait,…. summer 2021….. wait, fall 2021….. wait, winter 2021… wait, spring 2022…. and then, after the energy policy cemented,… “NOW” run in and jump – Summer 2022, with the rate hikes. The timing was by design.

Can you see it now?