War is an outcome of ideology and economics, and the latter is perhaps the most powerful weapon. As the harsh reality of Europe’s insufferable decades-long efforts to embrace the virtues of climate change begin to settle in, the reasonable adults in the conversation are able to see how their weakness is being exploited by their adversary.

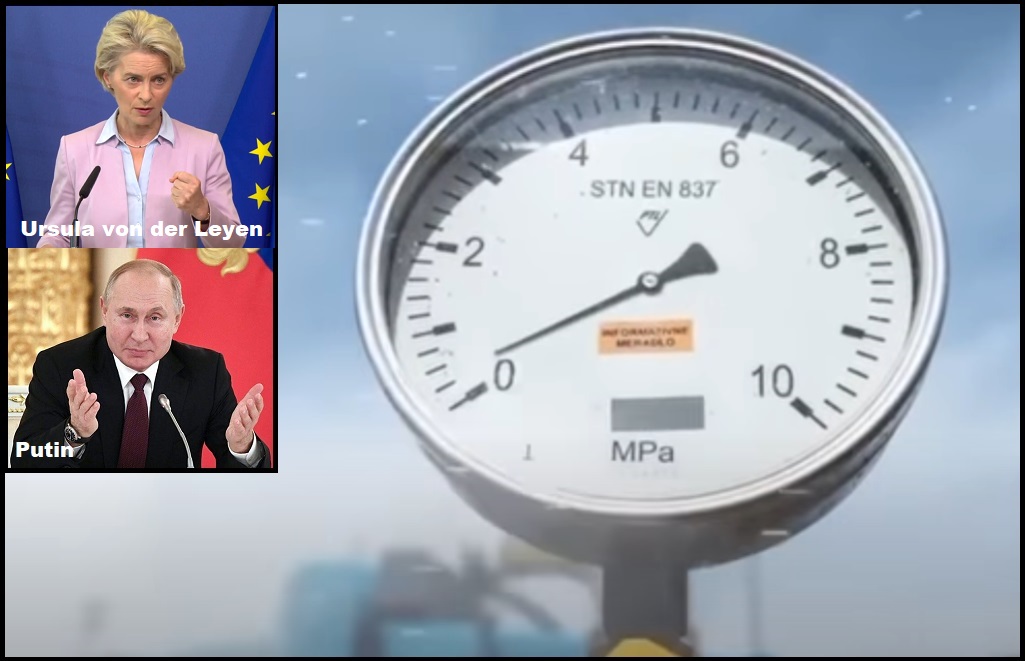

On Sept 7, the President of the European Commission, Ursula von der Leyen held a press conference in Brussels, announcing five initiatives to contain the expensive EU energy crisis: “The goal is clear. We must cut the revenues of Russia that Putin uses to finance this atrocious war against Ukraine.” {Go Deep}

On Sept 7, the President of the European Commission, Ursula von der Leyen held a press conference in Brussels, announcing five initiatives to contain the expensive EU energy crisis: “The goal is clear. We must cut the revenues of Russia that Putin uses to finance this atrocious war against Ukraine.” {Go Deep}

However, Russian President Vladimir Putin made it very clear that any further efforts to weaken his economy, via western sanctions and interventionist efforts against his economy, would be met with retaliation in the form of cutting off all oil and gas supplies to Europe. It appears the Europeans now understand the nature of their vulnerability.

(Via Reuters) – The EU has dropped plans to cap the price it pays for Russian gas.

Energy ministers from the bloc met Friday (September 9) in Brussels. They scrapped plans for the cap after the idea failed to win broad support.

Member states in central and eastern Europe who still get gas from Russia feared retaliation by Moscow. Russian President Vladimir Putin had said he would cut off supplies altogether if a cap was imposed.

However, ministers did agree to claw back revenues from some power producers and will use the money to curb consumer bills. European energy prices are typically set by gas plants. That leaves generators using nuclear, wind or coal raking in revenue, as their running costs haven’t risen as much or at all.

On Friday, some EU nations also argued in favor of a general cap on all gas imports. However, European energy commissioner Kadri Simson said any such move would be risky:

“The general price cap, including LNG imports, could present a security of supply challenge, because the LNG market is a global market. We are not among the three biggest LNG-importing regions or countries, and there is very strong competition in the LNG market and right now it is very important that we can replace the decreasing Russian volumes with alternative suppliers.”

The EU windfall plan will now be fleshed out in the coming days, with another meeting of energy ministers seen possible later in the month. (read more)

President of the European Commission, Ursula von der Leyen previously announced five initiatives to contain the expensive EU energy crisis: “The goal is clear. We must cut the revenues of Russia that Putin uses to finance this atrocious war against Ukraine. And now our work is paying off. At the start of the war, gas from Russian pipelines accounted for 40% of all imported gas. Today it has dropped to only 9% of our gas imports. These are tough times. But I am convinced that Europeans have the economic strength, the political will and the unity to maintain the upper hand,” she said. The United States and Norway are the primary suppliers of gas to the EU to fill the void.

Commissar von der Leyden’s five initiatives included:

(1) Conservation of electricity through forced and mandated cuts in electricity use. The amount of the cut has yet to be determined but reducing demand through forced curtailment of electricity use is the first approach. [Insert California as an example here in the United States.]

(2) A cap on the profit generated by energy suppliers who use renewable energy like wind and solar. The renewable industry has lower costs, yet they are profiting from the top line increase in delivered electricity. The EU commissar is proposing to confiscate the profits of Green Energy suppliers, direct the funds to the member states and then use those funds to subsidize the energy costs of poorer EU citizens.

(3) A cap on the profits generated by traditional fossil fuel energy suppliers (oil, coal, nuclear, gas electricity generation), and the diversion of those profits following the same formula as above.

(4) Banking support and financial liquidity for smaller regional energy providers who are having short term financial issues as they must pay massive amounts of money for the raw material needed to generate electricity. Essentially, the cost of coal, oil and LNG has skyrocketed, and there is a lag between the time they energy company must pay for the fuel source and the time the customer pays the electricity bill. The inbound fuel costs (new) are so extreme the inbound payments for prior electricity (old) are not covering the cost of the new supplier purchase.

(5) A price cap on Russian natural gas. To accompany the increased import of Norwegian and U.S. gas. This sounds like a bizarro effort to manipulate the market which could backfire. If Russian gas is cheaper than EU market gas, the smart energy providers will purchase the Russian gas.

Number five is now scrapped.

Not a single word about increasing the supply of any traditional energy resource. These EU ideologues -bureaucrats within a system that is not representative of democracy- are so committed to the cult of climate change and renewable energy, they are willing to destroy the EU economy in order to lower demand to the level of their windmills and solar farms. However, it looks like alternate, perhaps even sensible people within the EU, are starting to realize the ‘climate change’ ideologues are the real and present danger.