With most financial media being intentionally obtuse with the Biden economic impact upon Main Street, it is refreshing to see analysis that cuts to the heart of the matter. HatTip to ZeroHedge who provides a link to a great article outlining reality for blue and white-collar working families.

The folks at NerdWallet have taken the inflation date from the Bureau of Labor and Statistics (BLS) and applied the math to real life. The result is a good encapsulation of checkbook economics and how the Biden economy is painful for the working class.

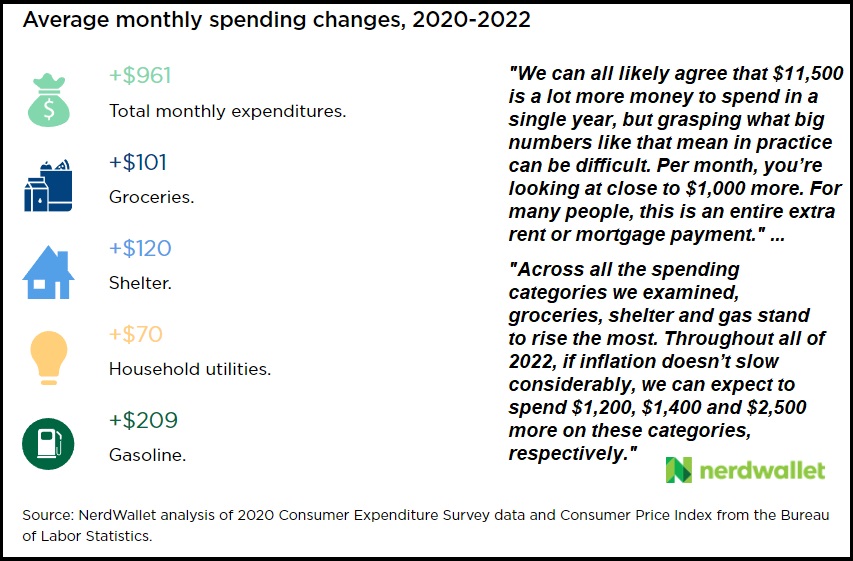

In total, Joe Biden’s energy policy driven inflation has added $961/month to preexisting expenses. That’s $11,532 a year just to retain the status quo standard of living.

(NerdWallet) – […] In all of 2020, American households spent $61,300, on average. This number includes everything we spend our money on: housing, food, entertainment, clothing, transportation and everything else. In 2022, it stands to reach $72,900, a difference of more than $11,500 if consumers want to maintain the same standard of living. Keep in mind, this is an average, a number that represents an approximation across all Americans, but one that’s exact to a very few. Those who earn (and therefore spend) more will see more dramatic dollar increases. Those who earn less may see less dramatic dollar jumps, but the impact of these rising prices could be more significantly felt. (read more)

If the average household spent $61,300 and inflation is adding $11,500 to the expense, that means we now have to spend 18.7% more just to maintain the current standard of living. That average is in line with what we are seeing in the real world.