The financial pundits are slowly starting to drop the pretending and discuss the bigger economic picture. However, as they tread very carefully, they are being very cautious about admitting too much.

A Reuters discussion of the comments by Federal Reserve Chairman Jerome Powell, starts to dip the media toe in the painful pool; yet they will not admit the Biden energy program is the source of the inflation Powell is targeting with his policy moves to shrink energy demand. Thus, the pretending continues.

A Reuters discussion of the comments by Federal Reserve Chairman Jerome Powell, starts to dip the media toe in the painful pool; yet they will not admit the Biden energy program is the source of the inflation Powell is targeting with his policy moves to shrink energy demand. Thus, the pretending continues.

If you take the written words and extract the parseltongue, you can see a more fulsome picture of what is being outlined.

JACKSON HOLE, Wyo., Aug 29 (Reuters) – The message from the world’s top finance chiefs is loud and clear: rampant inflation is here to stay and taming it will take an extraordinary effort, most likely a recession with job losses and shockwaves through emerging markets.

That price is still worth paying, however. Central banks spent decades building their credibility on inflation fighting skills and losing this battle could shake the foundations of modern monetary policy.

In other words, the U.S. economy is based on core U.S. energy systems and moving that construct to alternative energy, windmills, electric vehicles and solar panels; along with getting Americans to accept a lowered standard of living; is an “extraordinary effort.”

Yes, they are ‘all-in’ and if they lose “this battle,” the core foundations of modern monetary policy will “shake” along with the economic collapse that follows. The economic energy “transition” is the Biden policy, the federal reserve is trying to support that policy by lowering economic demand.

Yes, they are ‘all-in’ and if they lose “this battle,” the core foundations of modern monetary policy will “shake” along with the economic collapse that follows. The economic energy “transition” is the Biden policy, the federal reserve is trying to support that policy by lowering economic demand.

Yes, they also now admit that people will lose their jobs, their livelihoods and the foundation of their economic stability in the process.

[…] “Regaining and preserving trust requires us to bring inflation back to target quickly,” European Central Bank board member Isabel Schnabel said. “The longer inflation stays high, the greater the risk that the public will lose confidence in our determination and ability to preserve purchasing power.”

Banks should also keep going even if growth suffers and people start to lose their jobs. “Even if we enter a recession, we have basically little choice but to continue our policy path,” Schnabel said. “If there were a deanchoring of inflation expectations, the effect on the economy would be even worse.”

[Energy inflation, the root of all supply side inflation] “is near double-digit territory in many of the world’s biggest economies, a level not seen in close to a half century.”

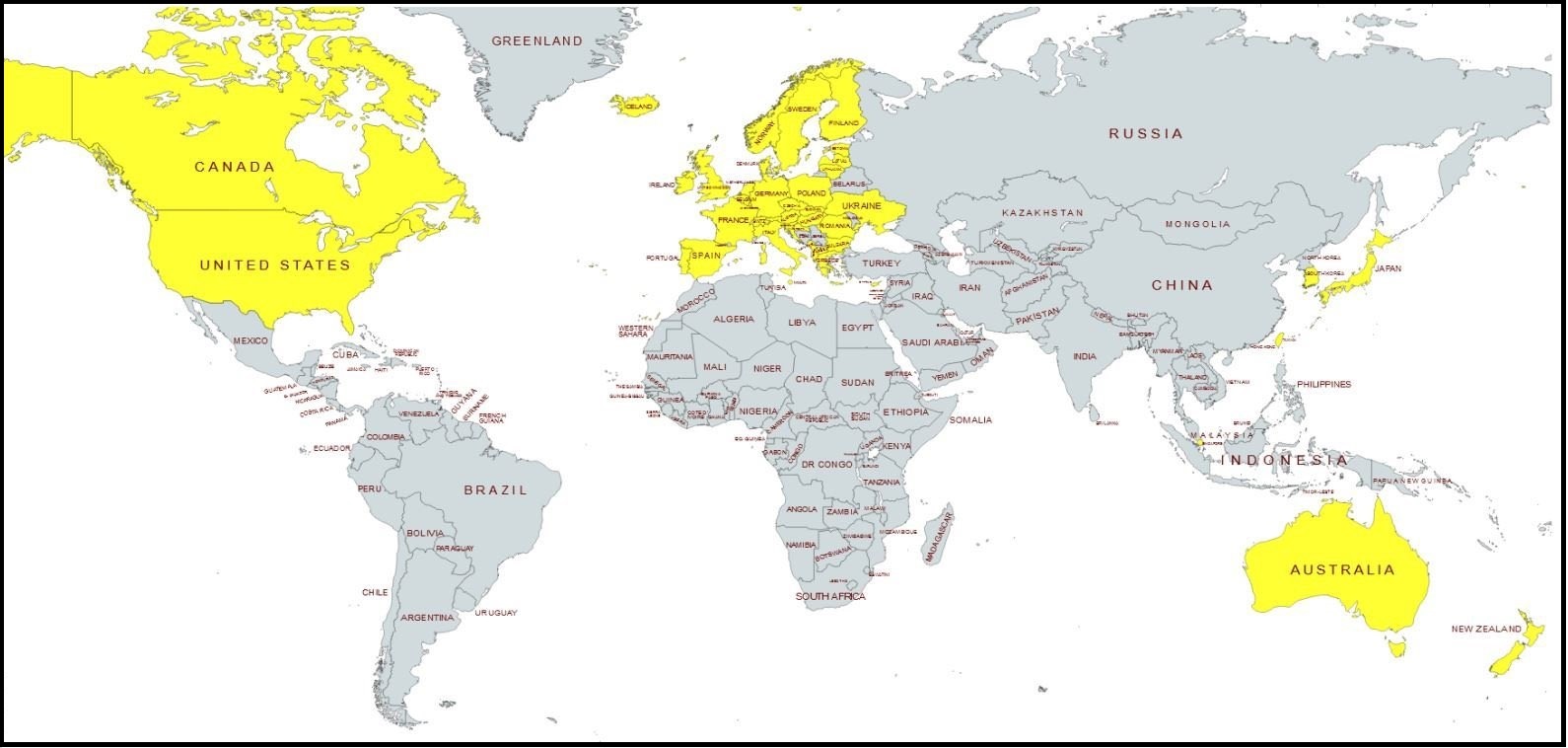

[…] Deglobalisation, the realignment of alliances due to Russia’s war, demographic changes and more expensive production in emerging markets could all make supply constraints more permanent. (read more)

Yes, the “realignment global of alliances,” as an outcome of the western world policy to fracture global markets based on energy use. Notice they are now starting to admit what we have discussed here for over a year?

“The global economy seems to be on the cusp of a historic change as many of the aggregate supply tailwinds that have kept a lid on inflation look set to turn into headwinds,” Agustín Carstens, the head of the Bank of International Settlements, said.

“If so, the recent pickup in inflationary pressures may prove to be more persistent,” said Carstens, who heads a group often called the central bank of the world’s central banks.

All this points to rapid interest rates hikes, led by the Fed with the ECB now trying to catch up, and elevated rates for years to come. (read more)

Indeed, we are only now on the front side “cusp” of the transition which will force the continued lowering of economic activity within the aligned nations for more than a generation or two. All economic activity, essentially all human activity, will have to be stalled and reduced until the levels of sustainable energy production can catch up to the levels of energy needed for the now smaller economy.

With current estimations of 50+ years before sustainable energy can generate 25 to 50 percent of the need, this is going to take a long time, and the bankers & financial control agents are going to have to simultaneously make the economies of the allied nations much smaller.

The planned energy oven is small, the size of the economic pizza must be shrunk in order to fit within it.

My last and important point is this…. The multinational corporations, banks and global finance folks, do not enter into these situations without a carefully planned way to retain their own wealth. The job of a “hedge fund manager” is described in the title, to find a “hedge” against risk to continue increasing wealth.

The billionaire elites that have assembled their wealth on the old economic system will not trust anything to chance as this global cleaving of the world economy takes place. Being reactionary is not how they operate. These groups pre-stage their wealth and assets outside the zone of collateral damage. They are proactive, not reactive to these global financial events.

With the foundation of the western economic system now being changed, look carefully at the political landscape to see what Wall Street risk mitigation maneuvers are taking place. My very strong hunch on this wealth preservation facet leads me back to domestic politics, and suddenly things make sense. I’m not wrong. I am open to being wrong, but I’m not wrong.