Treasury Secretary Janet Yellen delivered a remarkable speech yesterday outlining “the future of the international order,” in the aftermath of the global pandemic and the current conflict in Ukraine. Within the speech, Yellen outlines the priorities of the United States according to the current administration and the international financial mechanisms that she controls.

The speech is quite jaw-dropping when you consider the nature of her position, and the fact that she is an unelected bureaucrat within government.

The speech is quite jaw-dropping when you consider the nature of her position, and the fact that she is an unelected bureaucrat within government.

As you read the speech {Transcript Here}, keep in mind she is not the President of the United States, or the commissioner of the New World Order, yet she presents herself as authorized to control the geopolitical constructs of the Biden administration. The hubris is astounding.

Secretary Yellen: outlines the goals and objectives of the international order, predicts a concerning global famine, warns against the cleaving of financial mechanisms for international trade as an outcome of the Ukraine conflict, threatens any nation who does not support the western political alliance and outlines the need for decarbonization of the global economy.

Yellen expresses all of these powers from the position of a U.S. Treasury Secretary – the equivalent of a government financial minister. Speech highlights with emphasis mine:

(Transcript) – […] “Russia’s horrific conduct has violated international law, including core tenets of the UN Charter—challenging countries to demonstrate where they stand with respect to the international order that has been built since World War II. Therefore, when I speak about a changed global outlook, I’m not just talking about growth forecasts. I’m also referring to our conception of international cooperation going forward.

I will focus my remarks today on the significance of international cooperation in this current environment and for our future.

[…] With Attorney General Garland, I convened a novel taskforce of law enforcement and finance ministry leaders from G7 and partner countries to advance our efforts. […] Rest assured, until Putin ends his heinous war of choice, the Biden Administration will work with our partners to push Russia further towards economic, financial, and strategic isolation.

[…] When Russia made the decision to invade Ukraine, it predestined an exit from the global financial system. Russian leaders knew that we would impose severe sanctions. […] We are now seeing higher commodity prices that have added to global inflationary pressures and are posing threats to energy and food security, trade flows, and external balances across many countries.

[…] The ultimate outcome for the global economy of course depends on the path of the war. Russia could end this unnecessary war and the near-term impact could be contained.

[…] While many countries have taken a unified stand against Russia’s actions and many companies have quickly and voluntarily severed business relationships with Russia, some countries and companies have not. Let me now say a few words to those countries who are currently sitting on the fence, perhaps seeing an opportunity to gain by preserving their relationship with Russia and backfilling the void left by others. Such motivations are short-sighted. The future of our international order, both for peaceful security and economic prosperity, is at stake.

[…] The Russian invasion of Ukraine has dramatically demonstrated the need for us to stand together to defend our international order and protect the peace and prosperity that it has conferred on advanced and developing countries alike. […] On some issues, like trade and competitiveness, this will involve bringing together partners that are committed to a set of core values and principles.

[…] we need to modernize the multilateral approach we have used to build trade integration.

[…] we should implement last year’s global tax deal. Some 137 countries—representing nearly 95 percent of the world’s GDP—have agreed to rewrite the international tax rules to impose a global minimum tax on corporate foreign earnings and to partially reallocate taxing rights from countries where companies are headquartered to those where they sell goods and services.

[…] the economic and financial response to the global financial crisis in 2008-2009 was too timid and short-lived. With inadequate global liquidity, the crisis caused lasting damage. In response to the pandemic, the IMF acted creatively to support poorer countries. […] Experts put the funding needs in the trillions, and we have so far been working in billions. The irony of the situation is that while the world has been awash in savings—so much so that real interest rates have been falling for several decades—we have not been able to find the capital needed for investments in education, healthcare, and infrastructure.

[…] We know we have not yet done enough in terms of mitigation, adaptation, green technology innovation and adoption, and funding for those efforts. […] We must redouble our efforts to decarbonize our economies, recognizing that countries will use a range of tools—including carbon pricing, regulation, and subsidies—to achieve needed emissions reductions. Because those approaches will have quite different consequences for the costs of production, we will see differing impacts on trade competitiveness. We will need to work together to avoid trade tensions and in time to coordinate and harmonize our approaches.

[…] Some may say that now is not the right time to think big. Indeed, we are in the middle of Russia’s war in Ukraine, alongside the lingering fight against a global pandemic and a long list of other initiatives underway. Yet, I see this as the right the time to work to address the gaps in our international financial system that we are witnessing in real time. […] we ought not wait for a new normal. We should begin to shape a better future today.” {Read Full Transcript}

Think carefully about what you just read, and then remember the previous warning:

[CTH March 23, 2022] A Build Back Better society, or “great reset”, is factually underway as triggered by the gateway of SARS-CoV-2 and the massive spending by western nations to subsidize the lockdowns, shut-downs, economic closures and forced unemployment.

[CTH March 23, 2022] A Build Back Better society, or “great reset”, is factually underway as triggered by the gateway of SARS-CoV-2 and the massive spending by western nations to subsidize the lockdowns, shut-downs, economic closures and forced unemployment.

Global inflation is being driven not only by the American spending spree, but also by the massive government spending programs of the EU, U.K, New Zealand, Australia, Canada and many western nations.

The bills for those subsidies and bailouts are due. The labor of the citizens is going to have to pay those bills, while simultaneously we deal with inflation and massive debt balances on all nations’ balance sheets.

Into this mix comes the very real possibility of a declining U.S. trade dollar, as a result of geopolitical conflict between the west and Russia, China, Iran and OPEC in the geography of Ukraine. The financial sanctions by NATO and western allies have factually created a rift in currency exchange valuations.

As the proverbial west hammers those sanctions even harder and more deliberately, what they are doing is creating a stronger and greater likelihood that the dollar will be removed as the global trade currency, and we will enter a phase where two sets of nations exist:

One set of nations will run their economy on oil, gas and fossil fuels. The other set of nations will be focused on running their economic engine on the premise of sustainability, or renewable energy.

The sanctions toward Russia actually help to drive this chasm even wider.

To me, this looks entirely purposeful – done by specific intent and design.

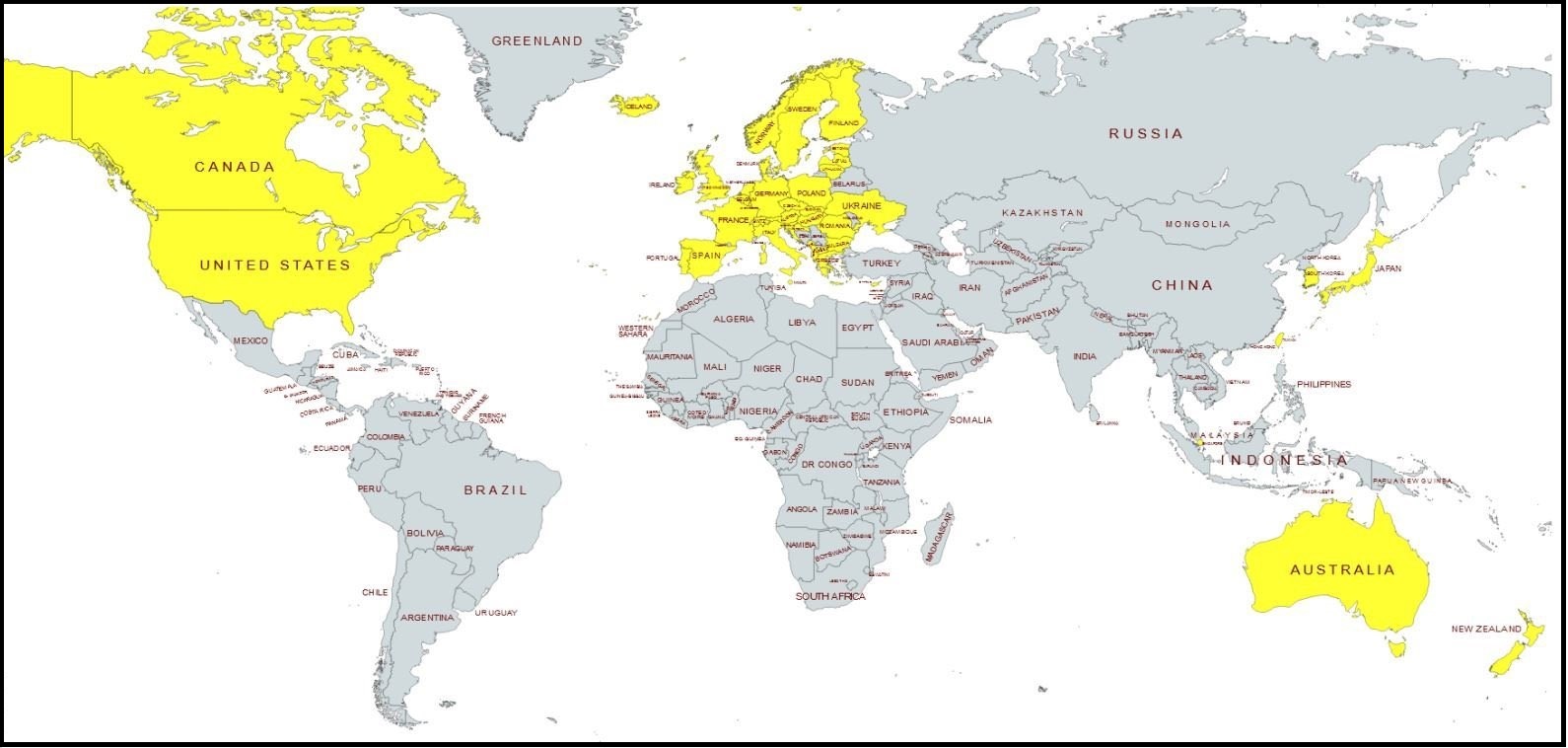

Two world groupings. One group, oil-based energy (traditional) – let’s label them the RED GROUP; and one group GREEN energy (the build back better plan). It is not accidental these two groups hold similar internal geopolitical views and perspectives.

♦ The important part to see is… there are going to be two sets of nations with two structurally different economies. A red group and a green group.

What Treasury Secretary Janet Yellen outlines in that speech is the geopolitics of this exact cleaving. Also worth noting, We The People represent the carbon she seeks to eliminate.