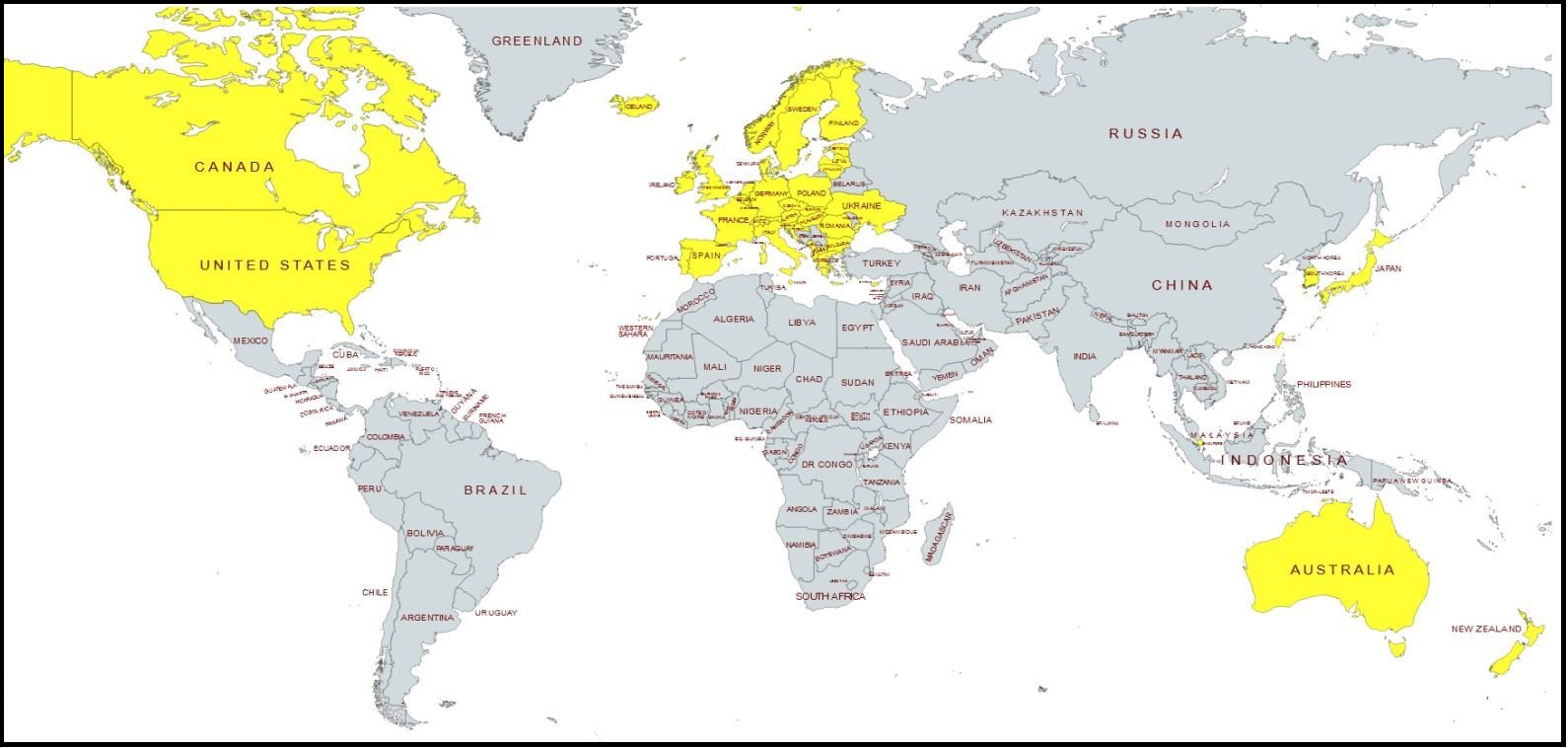

An enterprising journalist from Bolivia [Twitter Link] mapped the countries that support the sanctions against Russia (yellow) versus the countries that are not participating in the western sanctions against Russia (grey). The image provides a visual reference to consider our previous discussions about the cleaving of the global economy between two overarching ideologies.

In my estimation this intentional global cleaving, using the opportunity created by the Ukraine crisis, is going to be the major story of this year. This global splitting can be looked at in multiple ways, but the overarching story is the ramifications of two global trade relationships.

The western alliance (in the yellow above), has forced the world to reevaluate the dollar as the global trade currency, by denying Russia and their trade partners the ability to use the financial mechanisms under western control. To work around the sanctions, Russia is working on new financial systems to sell oil and farm products in non-dollar currencies. There is also a possibility the petro-dollar, for the global trade of oil, might be dropped.

Russia is part of OPEC. While many countries develop their own resources, OPEC sells the majority of oil the rest of the world consumes as the basis for their economic engine. One way to look at the global cleaving is to look at the way energy is viewed.

Two world groupings. One group, oil-based energy (traditional) – let’s label them the RED GROUP (grey on map), and one group GREEN energy (the build back better plan, yellow on map). It is not accidental these two groups hold similar internal geopolitical views and perspectives, hence, their alignment with the sanctions against Russia.

♦ The important part to see is… if this cleaving continues, there are going to be two sets of nations with two structurally different economies. A red group and a green group.

These two groups are going to end up in competition with each other. It is as inevitable as sunrise, if you can see this cleaving I am talking about.

Now, think about the economic system of trade that exists between the Red and Green groups. There has to be a way for them to exchange value if they are going to purchase from and sell to each other.

Additionally, and this is *key*, the Red group is going to have a strong strategic advantage in production costs. The Red group is going to be using oil, coal and gas (fossil fuels), which are abundant, cheap and the infrastructure is already in place.

The Green group is going to be at a strong disadvantage, at least for a generation or two, as the costs associated with the production of goods and systems is going to be much more expensive to operate, as the transition into Build Back Better sustainable or renewable energy takes place.

In the macro view, stuff from the Red group is going to be cheap. The exact same stuff from the Green group is going to be more expensive.

If you are still with me, hopefully, you can see how this is all coming together.

♦ The western debt incurred during COVID-19 is a problem. However, this debt diminishes with inflation. A $20 trillion debt is not as big a problem when bread costs $100/loaf and people are earning $50,000 a month. The Green group is entering into this position. In this position, the BlackRock approach of physical ownership of real estate and physical stuff is way more important than holding money or dollars which will immediately lose value.

Physical ownership of stuff is important.

♦ It is likely, based on the economic alignment, the Green group will be forced to assemble under one currency (set of financial valuations), and the Red group will then assemble under their own currency (set of financial valuations). My hunch is the western group (green) will use a digital currency.

Once both sets of currencies are established, then trade between the Red group and Green group can be determined based on a central valuation. In the Red group, a 20″ tire is worth 100 red bucks. In the Green group, a 20″ tire is worth 150 digital green bucks. Two vaults and two exchanges.

In order for all of this to come together, the population needs to be shifted in their perspective of money and material value. That takes us to where this conversation started by Blackrock and the World Economic Forum: “owning nothing and being happy” is akin to “prizing experiences over possessions.”

The Western financial mega-system operators (Blackrock, Vanguard) are going to own the physical assets, and the people will live under that ownership. The western construct of a modern serfdom. In the Red group, that socioeconomic system (essentially) already exists.

Last point, it is always important to remember the ultimate goal of the ‘climate change’ promotors is not an energy system that changes the global climate. The goal of the ‘climate change’ group is to create a carbon trading system; a new financial mechanism (a global tax program) to control human activity on a world-wide basis.

As a consequence, when we look at the fracturing of the global energy marketplace, it is worth viewing the Green group through the prism of their carbon trading scheme. As with the vaccination passport leading to a digital identity, the carbon trade program needs a similar unique id for carbon attribution.

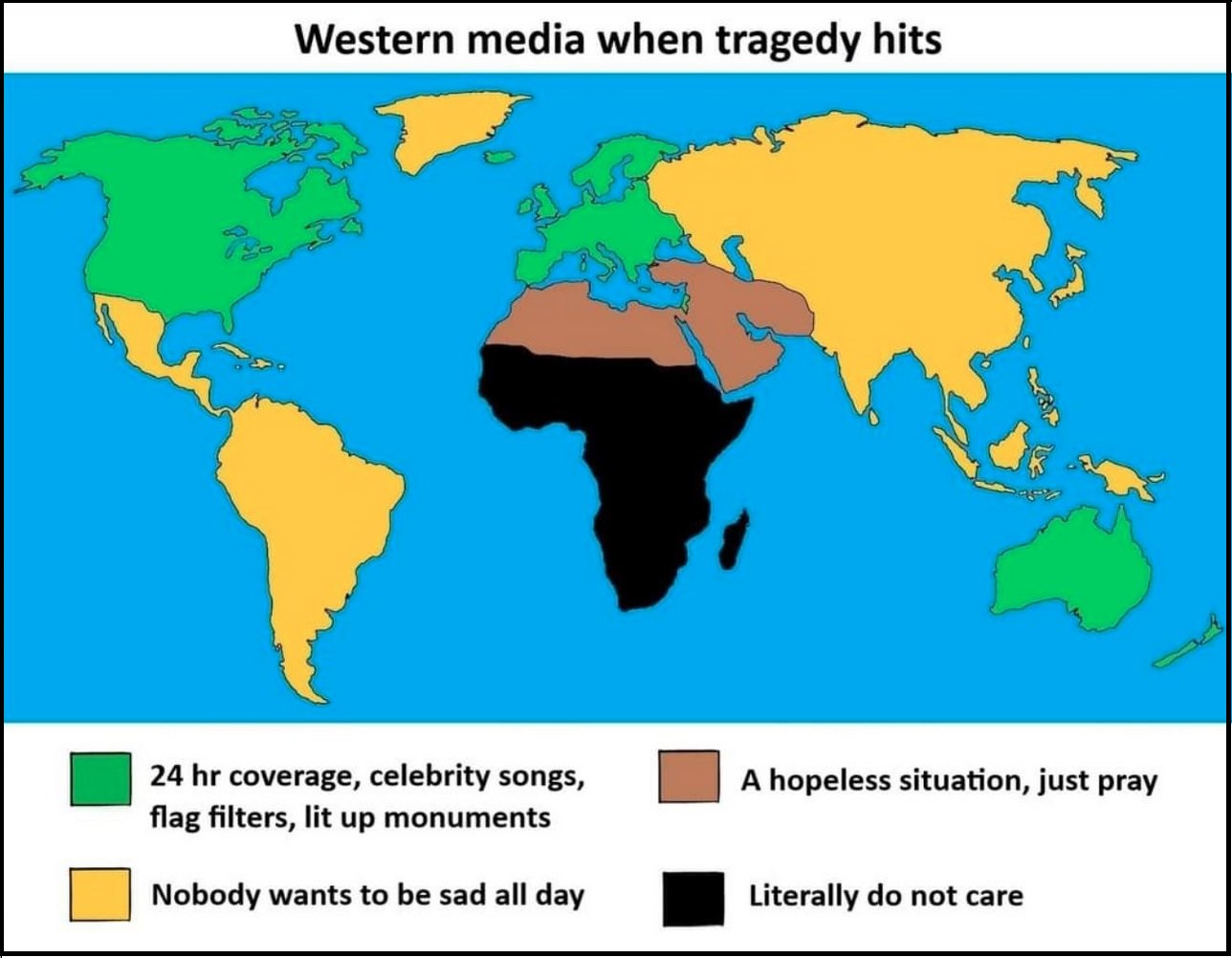

Another way to look at this map (notice the overlay):