People are starting to catch on. First, how it is surfacing:

(Zero Hedge) ...”traders are paying bumper premiums for immediate supply” … “Commodities are severely undersupplied” … “The shortage of, well, everything has translated into record price of virtually all commodities: the Bloomberg Commodity Spot Index, which tracks 23 energy, metals and crop futures, has touched a record this year. That has been driven in part by surging oil prices, which have hit their highest level since 2014.” (read more)

CTH readers are specifically well positioned to understand what is happening in the background we have discussed two specific issues:

(1) In any era of hyper-inflation, we always see the advanced purchasing of inventory for profit. Meaning, when prices are quickly rising multinationals use their size and power over commodity goods to store, physically or through contracted future purchases, goods that are held until a specific target price is reached and then sold for a bigger profit. In 2022 the “supply chain disruption” is being used as a cover.

(2) In the modern era, the major multinationals control the supply of originating products. There’s no such thing as a free market. In the modern era it is a controlled market.

Long before the word “inflation” hit the 2021 headlines, April/May of last year, CTH specifically identified where we are right now.

In the background right now, the multinationals are exploiting the two issues above. The Zero Hedge article “Shortages of Everything” is discussing the surfacing symptom, i.e. goods traders willing to pay premium prices to secure inventories, not necessarily the root cause.

All of these current outcomes are the results of a predictable sequence of events once you understand the correct cornerstone.

All of these current outcomes are the results of a predictable sequence of events once you understand the correct cornerstone.

CTH has been asked to revisit that foundational aspect so that current events are given a clearer and more predictable context.

Many Americans are recently awake to the singular ideology that surrounds DC politics. The UniParty political fraud also applies to our political economy.

However, just like the election, understanding the deception in modern economics means understanding previous false and promoted assumptions.

Economically speaking, Bernie Sanders supporters and the various left-wing advocates therein, are correct in stating the greatest financial and economic benefits have been delivered to the top 2% wealthiest people, the Wall Street class per se’.

Factually, while not resenting the wealth, most intellectually honest conservatives admit this is also the current reality. The wealth disparity in the U.S. increased substantially over the past two decades. It was only under the economic policy of Donald Trump, when the wealth gap actually began to close for the first time in decades.

Additionally, the professional political class would like both sides on the political continuum to continue disunity, argument/disagreement on the outcome and avoid discussing the root cause. It is within a comprehensive understanding of the root cause where Americans find unity.

We’ve already discussed how two entirely divergent economies, a Wall Street economy, and a Main Street economy, were created by exploitation of financial interests and the accompanying legislative priorities.

Regardless of mid-1980’s political motives, the result was the creation of two entirely disconnected economies. The professional political class merely pandered to the demands of their most influential legislative donors. Hence, TARP, Bailouts, etc.

Main Street’s economy was/is a more traditional economy, based on “Americanism” and economic patriotism. Wall Street’s economy is purely financial (mostly paper) and based on the multinational financial instruments that underline “Globalism“.

This is not to say that all Wall Street engagements or activities are bad, they are not. Financial instruments and corporate interests have a large place within our traditional economy. However, global financial instruments may, or may not, have a similar positive influence.

Given the historic rise of global corporatism and massive multinationals, it’s easy to spot the inherent anti-nationalist sensibility. Wealth doesn’t spread without a spreader; and American wealth doesn’t spread, without an American wealth spreader.

So, we end up with two economies, which, over time, have grown further and further apart. The wealth disparity between the middle class and the “well off” class, tracks identically with the separation of these two economies. – SEE HERE –

So, we end up with two economies, which, over time, have grown further and further apart. The wealth disparity between the middle class and the “well off” class, tracks identically with the separation of these two economies. – SEE HERE –

[…] there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street). [This important acceptance is just common sense. The U.S. GDP is currently around $20 trillion, but the total valuation of the Wall Street stock market is much larger than our GDP. Wall Street is more valuable than Main Street. It is a simple albeit important reality to accept.]

Investments, and the bets therein, needed to expand outside of the USA. Hence, globalist investing.

However, a second more consequential aspect happened simultaneously. The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence, Wall Street started funding political candidates and asking for legislation that benefited their interests.

When Main Street was purchasing the legislative influence, the outcomes were beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global” needs. Global financial interests, investment interests, are now the primary filter through which the DC legislative outcomes are considered.

There is a natural disconnect. (more)

President Trump was confronting multinational corporations and the global constructs of economic systems that were put in place to the detriment of the host (USA), ie YOU. There are trillions at stake. It is all about the economics; everything else is chaff and countermeasures.

The road to a “service-driven economy” is paved with a great disparity between financial classes. The wealth gap is directly related to the inability of the middle class to thrive.

Elite financial interests, including those within Washington DC, gain wealth and power. The U.S. workforce is reduced to servitude – “service”, of their affluent needs.

The destruction of the U.S. industrial and manufacturing base is EXACTLY WHY the middle class has struggled, and exactly why the wealth gap exploded in the past 30 years.

Behind this dynamic, we find the international corporate and financial interests who were inherently at risk from President Trump’s “America-First” economic and trade platform. Believe it or not, President Trump was up against an entire world economic establishment. Conversely, Joe Biden is an ally of the multinational corporations.

When we understand how trade works in the modern era, we understand why the agents within the system are so adamantly opposed to U.S. President Trump.

♦The biggest lie in modern economics, willingly spread and maintained by corporate media, is that a system of global markets still exists.

It doesn’t.

Every element of global economic trade is controlled and exploited by massive institutions, multinational banks and multinational corporations. Institutions like the World Trade Organization (WTO) and World Bank control trillions of dollars in economic activity.

Every element of global economic trade is controlled and exploited by massive institutions, multinational banks and multinational corporations. Institutions like the World Trade Organization (WTO) and World Bank control trillions of dollars in economic activity.

Underneath that economic activity, there are people who hold the reins of power over the outcomes. These individuals and groups are the stakeholders in direct opposition to principles of America-First national economics. Collectively they are known as “The Big Club”.

The modern financial constructs of these entities have been established over the course of the past three decades. When you understand how they manipulate the economic system of individual nations, you begin to understand why they are so fundamentally opposed to President Trump.

In the Western World, separate from communist control perspectives (i.e. China), “Global markets” are a modern myth, nothing more than a talking point meant to keep people satiated with sound bites they might find familiar. Global markets have been destroyed over the past three decades by multinational corporations who control the products formerly contained within global markets.

The same is true for “Commodities Markets”. The multinational trade and economic system, run by corporations and multinational banks, now controls the product outputs of independent nations. The free market economic system has been usurped by entities who create what is best described as ‘controlled markets’.

U.S. President Trump understood what had taken place. He used economic leverage as part of a broader national security policy; and to understand who opposes President Trump specifically because of the economic leverage he creates, it becomes important to understand the objectives of the global and financial elite who run and operate the institutions. The Big Club.

Understanding how trillions of trade dollars influence geopolitical policy, we begin to understand the three-decade global financial construct they seek to retain and protect.

That is, global financial exploitation of national markets.

FOUR BASIC ELEMENTS:

♦Multinational corporations purchase controlling interests in various national outputs (harvests and raw materials), and ancillary industries of developed industrial western nations. {example}

♦The Multinational Corporations making the purchases are underwritten by massive global financial institutions, multinational banks. (*note* in China it is the communist government underwriting the purchase)

♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

♦With control over the targeted national industry or interest, the multinationals then leverage export of the national asset (exfiltration) through trade agreements structured to the benefit of lesser developed nation states – where they have previously established a proactive financial footprint.

Against the backdrop of President Trump confronting China, and against the backdrop of NAFTA renegotiated, and against the necessary need to support the key U.S. steel and aluminum industries, revisiting the economic influences within the modern import/export dynamic will help conceptualize the issues at the heart of the matter.

There is a myriad of interests within each trade sector that make specific explanation very challenging; however, here’s the basic outline.

For three decades economic “globalism” has advanced, quickly. Everyone accepts this statement, yet few actually stop to ask who and what are behind this – and why?

Again, I’ll try to retain the larger altitude perspective without falling into the traps of the esoteric weeds. I freely admit this is tough to explain and I may not be successful.

Bulletpoint #1: ♦ Multinational corporations purchase controlling interests in various national elements of developed industrial western nations.

This is perhaps the most challenging to understand. In essence, thanks specifically to the way the World Trade Organization (WTO) was established in 1995, national companies expanded their influence into multiple nations across a myriad of industries and economic sectors (energy, agriculture, raw earth minerals, etc.). This is the basic underpinning of national companies becoming multinational corporations.

Think of these multinational corporations as global entities now powerful enough to reach into multiple nations -simultaneously- and purchase controlling interests in a single economic commodity.

A historic reference point might be the original multinational enterprise – energy via oil production. (Exxon, Mobil, BP, etc.)

However, in the modern global world, it’s not just oil; the resource and product procurement extend to virtually every possible commodity and industry. From the very visible (wheat/corn) to the obscure (small minerals, and even flowers).

Bulletpoint #2 ♦ The Multinational Corporations making the purchases are underwritten by massive global financial institutions, multinational banks.

During the past several decades national companies merged. The largest lemon producer company in Brazil, merges with the largest lemon company in Mexico, merges with the largest lemon company in Argentina, merges with the largest lemon company in the U.S., etc. etc. National companies, formerly of one nation, become “continental” companies with control over an entire continent of nations.

…. or it could be over several continents or even the entire world market of Lemon/Widget production. These are now multinational corporations. They hold interests in specific segments (this example lemons) across a broad variety of individual nations.

National laws on Monopoly building are not the same in all nations. Most are not as structured as the U.S.A or other more developed nations (with more laws). During the acquisition phase, when encountering a highly developed nation with monopoly laws, the process of an umbrella corporation might be needed to purchase the targeted interests within a specific nation. The example of Monsanto applies here.

Bulletpoint #3 ♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

Bulletpoint #3 ♦The Multinational Banks and the Multinational Corporations then utilize lobbying interests to manipulate the internal political policy of the targeted nation state(s).

With control of the majority of actual lemons, the multinational corporation now holds a different set of financial values than a local farmer or national market. This is why commodities exchanges are essentially dead.

In the aggregate, the mercantile exchange is no longer a free or supply-based market; it is now a controlled market exploited by mega-sized multinational corporations.

Instead of the traditional ‘supply/demand’ equation determining prices, the corporations look to see what nations can afford what prices. The supply of the controlled product is then distributed to the country according to their ability to afford the price. This is essentially the bastardized and politicized function of the World Trade Organization (WTO). This is also how the corporations controlling WTO policy maximize profits.

Back to the lemons. A multinational corporation might hold the rights to the majority of the lemon production in Brazil, Argentina and California/Florida. The price the U.S. consumer pays for the lemons is directed by the amount of inventory (distribution) the controlling corporation allows in the U.S.

If the U.S. lemon harvest is abundant, the controlling interests will export the product to keep the U.S. consumer spending at peak or optimal price. A U.S. customer might pay $2 for a lemon, a Mexican customer might pay .50¢, and a Canadian $1.25.

The bottom-line issue is the national supply (in this example ‘harvest/yield’) is not driving the national price, because the supply is now controlled by massive multinational corporations.

The mistake people often make is calling this a “global commodity” process. In the modern era this “global commodity” phrase is particularly nonsense.

A true global commodity is a process of individual nations harvesting/creating a similar product and bringing that product to a global market. Individual nations each independently engaged in creating a similar product.

Under modern globalism this process no longer takes place. It’s a complete fraud. Massive multinational corporations control the majority of production inside each nation and therefore control the global product market and price. It is a controlled system.

EXAMPLE: Part of the lobbying in the food industry is to advocate for the expansion of U.S. taxpayer benefits to underwrite the costs of the domestic food products they control. By lobbying DC, these multinational corporations get congress and policy-makers to expand the basis of who can use Food Stamps, EBT and SNAP benefits (state reimbursement rates).

Expanding the federal subsidy for food purchases is part of the corporate profit dynamic.

With increased taxpayer subsidies, the food price controllers can charge more domestically and export more of the product internationally. Taxes, via subsidies, go into their profit margins. The corporations then use a portion of those enhanced profits in contributions to the politicians. It’s a circle of money.

In highly developed nations this multinational corporate process requires the corporation to purchase the domestic political process (as above) with individual nations allowing the exploitation in varying degrees. As such, the corporate lobbyists pay hundreds of millions to politicians for changes in policies and regulations, one sector, one product, or one industry at a time. These are specialized lobbyists.

It is ironic when we discuss corporate financial payments to government officials in foreign countries we call them corrupt. However, in the United States we call it lobbying, the process is exactly the same.

EXAMPLE: The Committee on Foreign Investment in the United States (CFIUS)

CFIUS is an inter-agency committee authorized to review transactions that could result in control of a U.S. business by a foreign person (“covered transactions”), in order to determine the effect of such transactions on the national security of the United States.

CFIUS operates pursuant to section 721 of the Defense Production Act of 1950, as amended by the Foreign Investment and National Security Act of 2007 (FINSA) (section 721) and as implemented by Executive Order 11858, as amended, and regulations at 31 C.F.R. Part 800.

The CFIUS process has been the subject of significant reforms over the past several years. These include numerous improvements in internal CFIUS procedures, enactment of FINSA in July 2007, amendment of Executive Order 11858 in January 2008, revision of the CFIUS regulations in November 2008, and publication of guidance on CFIUS’s national security considerations in December 2008 (more)

Bulletpoint #4 ♦ With control over the targeted national industry or interest, the multinationals then leverage export of the national asset (exfiltration) through trade agreements structured to the benefit of lesser developed nation states – where they have previously established a proactive financial footprint.

The process of charging the U.S. consumer more for a product, that under normal national market conditions would cost less, is a process called exfiltration of wealth. This is the basic premise, the cornerstone, behind the catchphrase ‘globalism’.

It is never discussed.

To control the market price, some contracted product may even be secured and shipped with the intent to allow it to sit idle (or rot). It’s all about controlling the price and maximizing the profit equation. To gain the same $1 profit, a widget multinational might have to sell 20 widgets in El-Salvador (.25¢ each), or two widgets in the U.S. ($2.50/each).

Think of the process like the historic reference of OPEC (Oil Producing Economic Countries). Only in the modern era massive corporations are playing the role of OPEC, and it’s not oil being controlled. Thanks to the WTO it’s almost everything.

Again, this is highlighted in the example of taxpayers subsidizing the food sector (EBT, SNAP etc.), the corporations can charge U.S. consumers more. Ex. more beef is exported, red meat prices remain high at the grocery store, but subsidized U.S. consumers can better afford the high prices.

Of course, if you are not receiving food payment assistance (middle class), you can’t eat the steaks because you can’t afford them. (Not accidentally, it’s the same scheme in the ObamaCare healthcare system)

Agriculturally, multinational corporate Monsanto says: ‘all your harvests are belong to us‘. Contract with us, or you lose, because we can control the market price of your end product. Downside is that once you sign that contract, you agree to terms that are entirely created by the financial interests of the larger corporation, not your farm.

Agriculturally, multinational corporate Monsanto says: ‘all your harvests are belong to us‘. Contract with us, or you lose, because we can control the market price of your end product. Downside is that once you sign that contract, you agree to terms that are entirely created by the financial interests of the larger corporation, not your farm.

The multinational agriculture lobby is massive. We willingly feed the world as part of the system; but you as a grocery customer pay more per unit at the grocery store because domestic supply no longer determines domestic price.

Within the agriculture community, the (feed-the-world) production export factor also drives the need for labor. Labor is a cost. The multinational corps have a vested interest in low labor costs. Ergo, open border policies. (i.e. willingly purchased Republicans not supporting border wall etc.).

This corrupt economic manipulation/exploitation applies over multiple sectors, and even in the sub-sector of an industry like steel. China/India purchases the raw material, coking coal, then sells the finished good (rolled steel) back to the global market at a discount. Or it could be rubber, or concrete, or plastic, or frozen chicken parts etc.

The ‘America First’ Trump-Trade Doctrine upset the entire construct of this multinational export/control dynamic. Team Trump focused exclusively on bilateral trade deals, with specific trade agreements targeted toward individual nations (not national corporations).

‘America-First’ was a specific policy at a granular product level looking out for the national interests of the United States, U.S. workers, U.S. companies and U.S. consumers.

Under President Trump’s trade and tariff positions, balanced and fair trade with strong regulatory control over national assets. Exfiltration of U.S. national wealth was essentially stopped.

This put many current multinational corporations, globalists who previously took a stake-hold in the U.S. economy with intention to export the wealth, in a position of holding contracted interest of an asset they couldn’t exploit.

Perhaps now we understand better how massive multi-billion multinational corporations, the World Economic Forum and the political institutions they pay for, were/are aligned against President Trump; and they would never relent in their need to see the risk he/we represents destroyed.

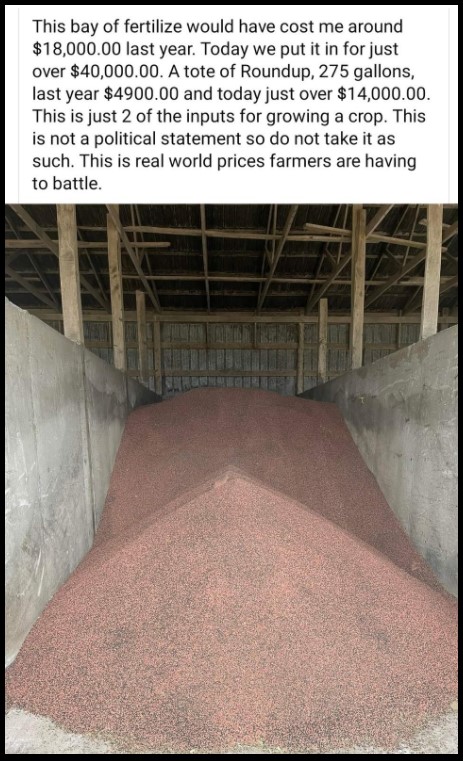

In 2022 it surfaces like this: