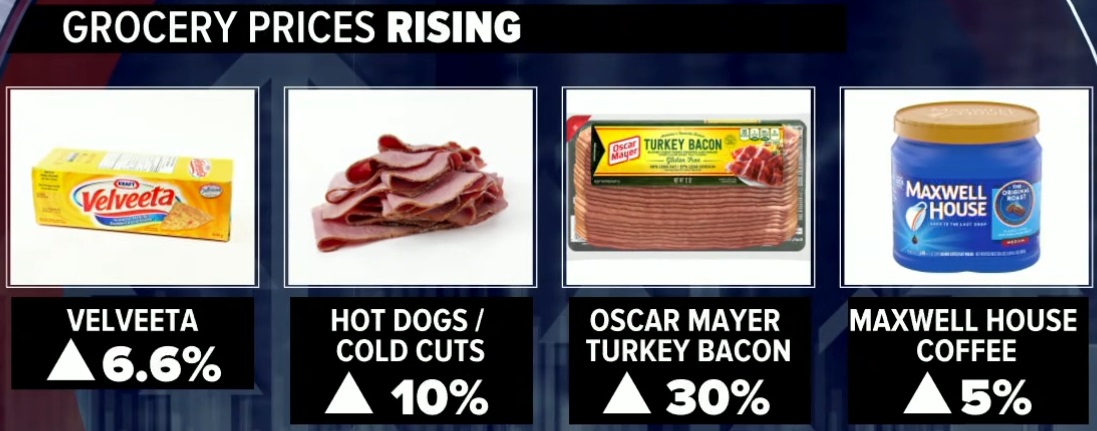

Kraft-Heinz has announced the next wave of anticipated inflationary prices for their products. The announcement, and the timeline they provide for the price increases, is exactly in line with our prior estimations.

Prior CTH outlines on the path of inflation for this specific company are HERE (Dec) and HERE (Jan). Keep in mind, depending on the size of the buyer or wholesaler, and depending on the terms of the contracts for purchase, generally speaking, terms are net payment in 30, 60 or 90 days based on 180 day contracted price agreements which include rebates to retailers.

(Reuters) […] “The company expects inflation to be in the low-teens percentage range for 2022, with higher levels in the first half than in the second, said Chief Financial Officer Paulo Basilio.” (link)

Both Proctor & Gamble and Kraft-Heinz provide the best data points to predict future retail grocery inflation. Based on their previous notifications, we can now see that Kraft is anticipating the March – July rates of increase to remain approximately where they have been (20 to 30%) and then stabilize in the last half of the year bringing the yearly average into the “low teens.” This timeline is what we predicted back in October.

The prices we will see at the grocery stores will rise again in the spring (this is the backside of the inflationary cycle), continue through mid-summer, and then price increases should likely level off at the end of summer this year. Between the price today and the price at the point of leveling is approximately a 20% increase.

Each segment is different. However, on average a $5 item now will cost around $6 mid-summer, then settle. Average food basket prices going into the July 4th holiday will be approximately 20% higher than current, and 40% higher than July 2021. Some items will be 50 to 60% higher July 4, 2022, versus July 4, 2021.

Dairy products into manufacturing and processing went up 4.5% last month alone. Those price increases will continue accumulating into the products as ingredients. Expect another +25% on dairy goods at retail. Plastic packaging (jugs etc) is part of that product price.

Dairy products into manufacturing and processing went up 4.5% last month alone. Those price increases will continue accumulating into the products as ingredients. Expect another +25% on dairy goods at retail. Plastic packaging (jugs etc) is part of that product price.

Household chemicals, cleaning products, laundry detergents, paper goods as well as health and beauty care products like soaps, shampoos, dental and cosmetics, will see much higher price increases than food products because the raw materials (bases and chemicals) are off the charts higher in price. Cleaning products at wholesale jumped 3.8% in January alone. Expect to see anything containing chemicals on the extreme high end of price increases this year.

Another serious issue are paper and cardboard prices which are likely going to jump another 30 to 50% before they stop (if they do). Everything above comes shipped in boxes, so the cost of products carries the increased cost of the shipping cardboard.

Keep in mind a few points:

(1) The outlined price increases noted are against current price terms and contracts. Meaning, these are price increases from right now to the next fulfillment. These are not inflation price increases which are compared to a year ago. These are 5% to 20% increases from the current price right now.

(2) The price increases are not the final price increase. This is the price of a contract today from the field to the distribution center. The retailer also has additional price increases (transportation, energy, labor, etc) which they need to add to the wholesale price before you see the final price at retail (grocery store).

The final field to fork price is not yet known but will be higher than noted above. We are only seeing the notifications from field, through processing (Kraft and P&G) and into warehousing and distribution.

Additionally, the more an item needs to be processed, the higher the price increase will be. Food items that require multiple raw materials, ingredients and bases for processing (ex. condiments), when combined with increased packaging costs (oil, energy), will be much higher than foods with less processing, handling and packaging.

Additionally, the more an item needs to be processed, the higher the price increase will be. Food items that require multiple raw materials, ingredients and bases for processing (ex. condiments), when combined with increased packaging costs (oil, energy), will be much higher than foods with less processing, handling and packaging.

This has always been the nature of this specific supply chain.

Example: Many products, food, drinks and even cleaning products, contain citrus bases, additives, flavorings and distillation. Those products will be much higher in price due to the price increases in raw materials, combined with higher energy and petroleum costs. It is an issue of cumulative price increases in the production of the product from beginning to end.

Unfortunately, pet foods, specifically wet pet foods, will also be on the higher end of the price increases. Pet foods are subject to the higher end of price increases due to manufacturing and processing. Many high-end wet pet foods are also imported, so the transportation costs are higher.

CTH has recommended preparing for these massive increases in 2022 prices by thinking about the base products you use to make meals at home and holding an extra supply of shelf stable products, so you won’t hit the grocery store and face those massive increases. Another example will be coffee. Keep in mind Kraft Foods is Maxwell House, and coffee requires roasting (another energy cost).

The $200 food basket in early 2021 is now around $275. That same food basket will likely reach $325 this summer. I wish there were a better way to put it, because at the end of these price jumps is a lot of hardship for many working families.

Believe me, I feel that pain. I know what it looks like to see a grocery bill at checkout that suddenly makes the monthly car, rent or mortgage payment more challenging. That’s why we have been trying to support everyone with fact-based expectations since last fall, so we could help readers prepare ourselves to support our families, kids and grandkids who might be seeing these issues for the first time in their lives.

On the durable goods side of the equation, other than energy-price-impacted goods (tires, oils, rubber components etc), we can expect to see price increases of durable goods (electronics etc) settle down much faster this year, likely before spring. Unfortunately, the reason is obvious as demand is continuing to drop.

We must get the Democrat Communists out of office and stop the assault on the energy industry before it’s too late. If we do not get rid of them, we will lose the middle class.

Let’s Go Brandon!