Has there been a massive exodus of capital out of the Canadian financial system?

A few obscure but interesting data-points seem to indicate Justin Trudeau’s unprecedented use of the federal government and intelligence apparatus to target the bank accounts of Canadian citizens has just created a serious problem for their financial institutions.

If I was a betting person, I would bet half my stake that something very serious is happening in the background of the Canadian financial system, and it appears the leaders inside government, as well as leaders in the international financial community, are reacting and trying to keep things quiet. Stick with me on this and stay elevated…

BACKGROUND – When Prime Minister Justin Trudeau announced he was invoking the Emergency War Measures Act to seize bank accounts and block access to the financial system for people who were arbitrarily deemed as terrorists to the interest of the Canadian government, i.e. the Freedom Protest group writ large, many people immediately thought about the consequences of a government taking such action.

Indeed, the first response to many who witnessed the gleeful declarations of the Canadian government as they expressed their intent to utilize their emergency power, was that this was seriously going to undermine faith and confidence in the Canadian financial systems. The RCMP is the Canadian equivalent of the FBI.

If the government can work with the RCMP to target people based on an arbitrary political decree, and then control your bank account while simultaneously giving financial institutions liability protection for their participation, the confidence in the banking system is immediately undermined.

What might seem like a great tool for political punishment has long term consequences, especially if people start withdrawing their money and/or shifting the placement of their investments to more secure locations away from the reach of the Canadian government. Considering the rules of fractional banking and deposits, it doesn’t take many withdrawals before the banks have serious issues.

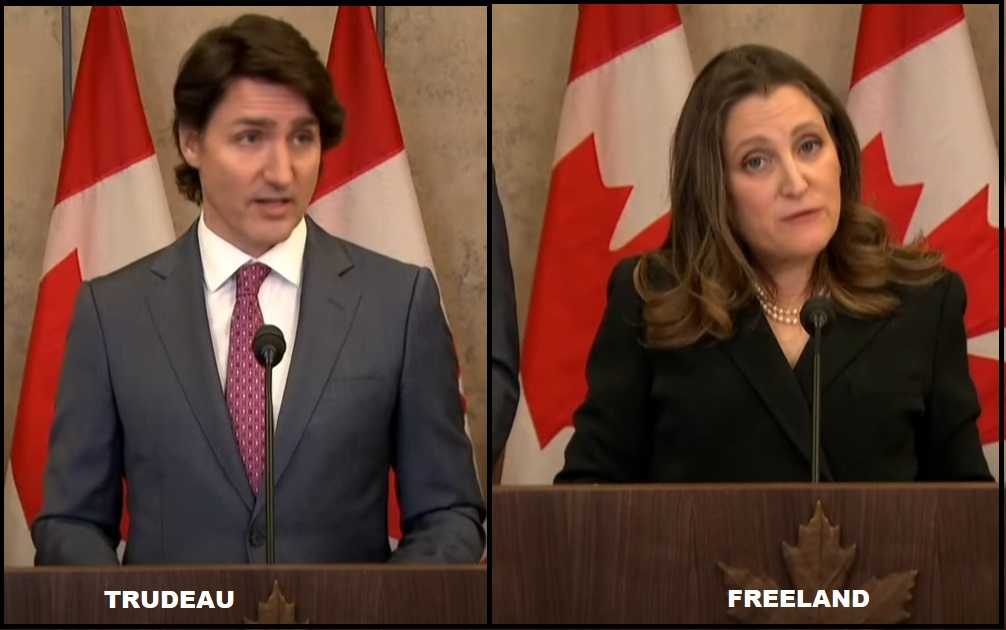

DATA POINTS – In addition to being Justin Trudeau’s deputy prime minister, Chrystia Freeland is also the Finance Minister of Canada. Yesterday, a very twitchy, nervous and gasping for breath Freeland was noted in a very agitated state when she attended the press conference of her boss. Factually you can watch the video and see how stressed she was and incapable of keeping herself stable [SEE HERE].

DATA POINTS – In addition to being Justin Trudeau’s deputy prime minister, Chrystia Freeland is also the Finance Minister of Canada. Yesterday, a very twitchy, nervous and gasping for breath Freeland was noted in a very agitated state when she attended the press conference of her boss. Factually you can watch the video and see how stressed she was and incapable of keeping herself stable [SEE HERE].

Watch that video from the perspective that someone in the international financial world, IMF, World Bank or other affiliate in the world of collective finance has just had a very serious talk with Finance Minister Chrystia Freeland.

♦ Shortly after that very awkward performance, Finance Minister Freeland’s assistant deputy, Isabelle Jacques, informed a parliamentary committee that all bank accounts frozen by the federal government’s use of the Emergency Act, were immediately being unfrozen.

( VIA CBC ) – […] More than 200 bank accounts worth nearly $8 million were frozen when the federal government used emergency powers to end a massive protest occupation of downtown Ottawa. Federal officials report most of the accounts are now in the process of being released, a parliamentary committee heard Tuesday.

Isabelle Jacques, assistant deputy minister of finance, told a committee of MPs that up to 210 bank accounts holding about $7.8 million were frozen under the financial measures contained in the Emergencies Act. (read more)

Obviously, many people realized from the outset what the Canadian government had done was tenuously legal at best, provided no legal due process or right of challenge, and likely would not pass any serious legal scrutiny. Unfortunately, in the echo chamber that is far-left liberalism, such matters are not as important as the ideological political motives; but there are people who realize the consequences of power-lust in this application.

Without a doubt, just as you were likely stunned, amazed and then angered by the financial punishment declared by Trudeau, there are people aligned with Trudeau –outside his government– who could see a bigger picture of consequence than those inside the echo chamber.

Central banking finance ministers around the world obviously would pay close attention to what Trudeau just announced, and there are certainly people in the World Economic Forum (WEF) group, International Monetary Fund (IMF) and central bankers who would not be happy about the Canadian government showing just how easy it is to snatch money out of the hands of citizens.

These tools of citizen control are things well known to the central bankers and control agents of finance, but they are never spoken about in polite company – let alone publicized, promoted and openly bragged about.

Justin Trudeau and Chrystia Freeland essentially broke the financial code of Omerta, by highlighting how easy it is for government to seize your bank accounts, credit cards, retirement accounts, insurance, mortgages, loan access and cut you off from money.

Worse yet, the short-sighted Canadian government via Minister Freeland announced their ability to control cryptocurrency exchanges in their country and block access within a financial mechanism that exists almost entirely as an insurance policy and hedge against the exact actions the government was taking.

♦ A very nervous Finance Minister, Chrystia Freeland, appears with Trudeau to talk about Ukraine.

♦ Freeland’s underling, Deputy Minister Jacques, is simultaneously telling parliament the bank accounts are being unfrozen.

♦ The CBC then reports that RCMP officials are taking a 180° reversal in position, about asset seizures.

Then there’s this supportive data-point from Jordan Peterson (Direct Rumble Link):

Is the Canadian government now experiencing a serious financial problem as the result of Trudeau and Freeland’s totalitarian lust for power and use of finance to crush their political opposition?

Apply Occam’s Razor here and the result is akin to: ‘How couldn’t they“.

Once that tool is deployed, there’s no putting the toothpaste back into the tube.