The pundits are just not getting it. It’s the inflation, stupid.

The Bureau of Labor and Statistics (BLS) released the December jobs report today [DATA HERE] showing 199,000 job gains in December, approximately half of what was expected. Most financial pundits are perplexed as the employment rate drops to 3.9%, because many people have dropped out of the labor force. The labor participation rate remains unchanged at 61.9%.

Keep in mind, the November jobs report showed a decline in retail jobs of 29,000, and this report shows that despite November & December being the largest shopping months for holidays, the retail sector jobs were nonexistent.

Keep in mind, the November jobs report showed a decline in retail jobs of 29,000, and this report shows that despite November & December being the largest shopping months for holidays, the retail sector jobs were nonexistent.

The issue is what we have discussed here for months, inflation.

The job quits and JOLT turnover reports from last week showed massive numbers of employees quitting their jobs. In part this is pressure from the vaccine mandate (more on that later). However, in the majority what we are seeing is employment decisions based on inflation hitting the labor market.

Additionally, the current BLS report does not have the Omicron “winter of death” employment impact within it. That impact will come in the January report, and it will not be good. But let’s get down to reconciling December jobs data with reality on the ground.

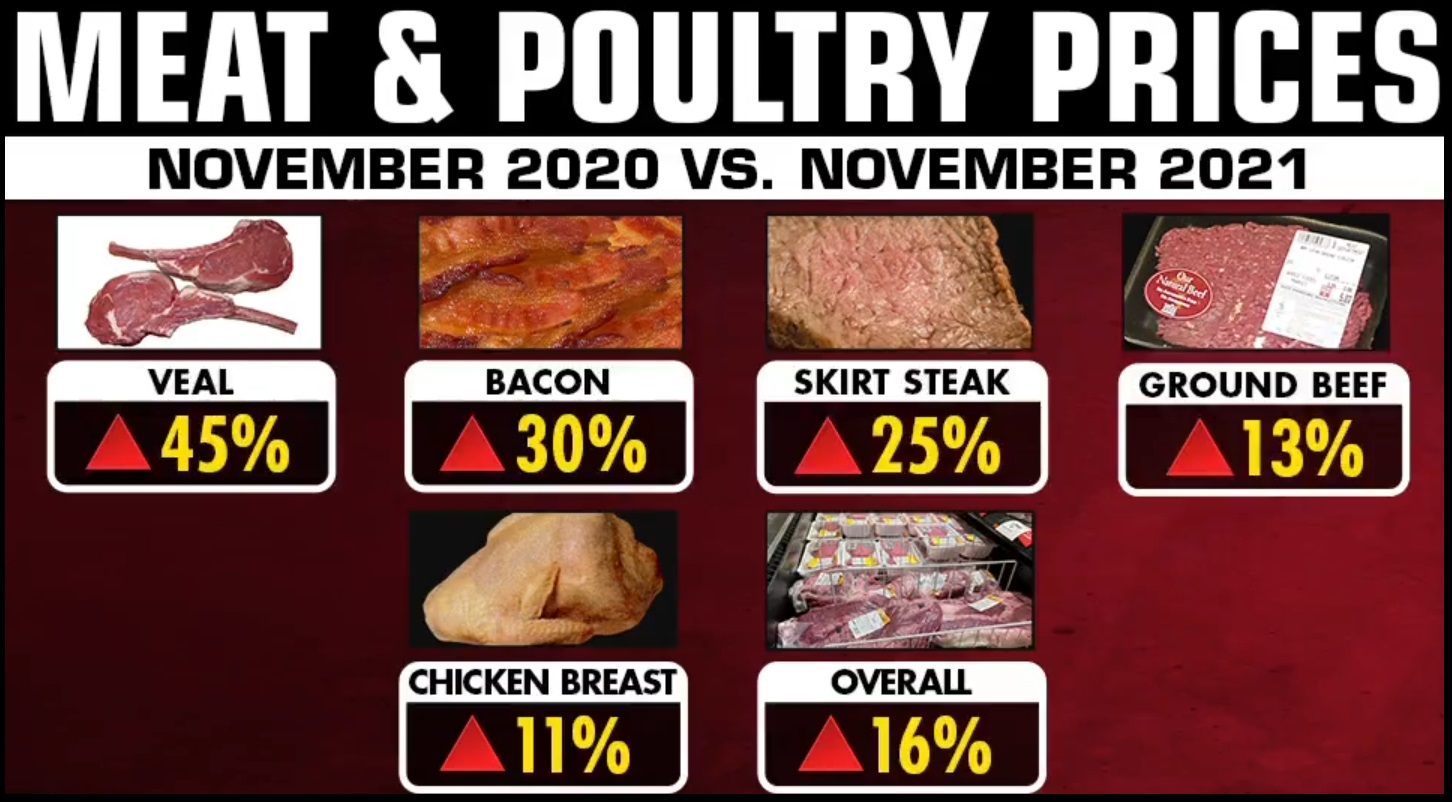

Inflation is chewing up income amid the workforce. This is not debatable, and this is reflected in every opinion poll and economic statistic that has surfaced for the past six months. The BLS report somewhat surprised people in the 0.6% wage gains, and average wage increases are now 4.7% year over year. That should be a good thing. However, inflation at 20 to 50+% on energy, fuel, gasoline and food means a 4.7% growth in wages is a pittance.

A nickel more for a dollar earned is futile against food store inflation at 20 to 40% average price increases. We have never seen food, fuel and energy increase in price at such a rate and in such a short period of time (6 months). That real price situation is not going to improve. Economists call this “sticky” inflation, but that catch phrase does not adequately explain the foreboding issue of how damaging this is.

As this inflation relates to jobs and employment, the situation is obvious. Pundits pretend not to know things, but the two issues are connected. Ordinary workers need much higher wages to compensate for massive increases in housing costs, energy costs, gas prices and, more importantly, food prices.

The fastest way to get a quick pay increase to compensate for fast and furious inflation is to switch jobs and start the new job, in the same sector, at a higher wage. That is what we are seeing with the overall turnover rate, quits report, and larger employment data. They are all connected.

Beyond inflation, you can see from this BLS data that things are tenuous in the economy. The November retail employment figure (-29,000) was a big red flag that everyone ignored. Additionally, holiday sales at +8% when the prices are +15% or more, means that people were buying less stuff at higher prices. Overall, less stuff (units sold) was purchased.

The December BLS data shows us actual hours worked in manufacturing declined (0.1 hrs), and overtime declined (0.1 hrs). Remember, the third quarter productivity rate dropped a stunning 5% overall.

Big Picture = less stuff is in demand, less stuff is being made, and less hours are being used; however, the amount of available labor in the creation of durable goods still exceeds the demand for those durable goods, hence productivity has dropped.

Construction employment is modest at +22,000 in December, but it is lower than the prior three months average of +38,000. Some of this is seasonal, but the trendline is much softer than a customary 3.9% total unemployment economy would show. Again, more evidence of weakness in the structural economy (no pun intended).

Two-thirds of the U.S. economy overall is dependent on people buying stuff. When people cannot afford to buy stuff, because their disposable income has been wiped out by inflation, things in the data start to show the wobbly wheels of a tenuous economic train.

When the number of people quitting their jobs, or switching jobs, is twice the number of people getting officially hired in the BLS jobs report, then you know things are sketchy.

Let me repeat the issue and try to emphasize the problem. It’s the inflation, stupid.

.

We have a looming problem that does not reconcile with 3.9% unemployment. The pundits are perplexed.

The confusion is because NO ECONOMIC data has ever shown this level of inflation in such a short period of time. There are no models. There is no experience in this situation. This is not like the 1970’s where oil prices were the direct and primary cause. This is different, because we are experiencing shortages and price increases specifically due to policy.

Energy policy is killing us (oil and natural gas prices). Legislative policy is killing us (spending and bailouts). Monetary policy is killing us (cheap lending, quantitative easing, devaluation). All of this is causing massive inflation at a level we have never seen in history, and it’s on everything.

Then we throw in a vaccine mandate, and perpetual fear of a virus that hits both the demand side and the employment side simultaneously…. and, well, here you go. The disruptions inside the economy are like deep cuts, thousands of them, and they are not accidental.

Many, if not most, of these disruptions are being done at the altar of climate change and the Green New Deal.

COVID-19 mitigation and mandates only make this worse.

The disruptions in the supply chain are a direct result of policy. Now, we have to prepare for inflation AND shortages. This will not get better in 2022.

Prepare your family accordingly. I believe those of you reading this article represent the people best prepared for what is about to happen.