The Bureau of Labor Statistics (BLS) released the November job openings and turnover data today [DATA HERE] showing 370,000 workers quit their jobs in November bringing the quits rate now to 4.5 million people.

From the report, “Quits increased in several industries with the largest increases in accommodation and food services (+159,000); health care and social assistance (+52,000); and transportation, warehousing, and utilities (+33,000).”

Over the 12 months ending in November 2021, hires totaled 74.5 million and separations totaled 68.7 million, yielding a net employment gain of 5.9 million for 2021. However, while the unemployment rate drops with fewer people working, the employment picture overall appears to be tenuous.

The FRED personal savings rate for Americans overall [DATA HERE] has been dropping rapidly since March 2021, the last federal COVID employment bailout injection. All of the federal assistance has created massive data skews in the savings rate, as federal subsidies gave an artificial boost to the U.S. savings rate.

It appears that the aggregate American worker is now using their savings, created by COVID bailouts, to offset the massive inflation created by the COVID bailouts. The net result is a workforce going into negative savings each month as inflation driven expenses (energy, fuel, food) are higher than earnings. This is an unsustainable situation.

There is obviously a large retirement factor in the quits rate; however, it does appear the vaccination mandate is also a major influence. Additionally, when talking about people living paycheck-to-paycheck, rapid inflation almost always causes job-jumping for workers to get higher wages.

According to the BLS data, in November the job openings rate decreased in small establishments with 10-49 employees. This could be due to employees returning to small business, and/or there are fewer small businesses around to be hiring.

The hires rate rate increased in very large employers with 5,000 or more employees. However, the quits rate increased in both small businesses with 1-9 employees and in medium-sized businesses (1,000 to 4,999 employees). The I9 contracted workers are also leaving small and mid-size employers.

Then comes a significant aspect, “both the layoffs and discharges rate -and the total separations rate- increased in the larger establishments with 1,000 to 4,999 employees.” This could indicate mid-sized businesses are starting to see contractions in sales or demand and lowering their payrolls. This outlook would match the productivity drops we noted last month.

(DECEMBER CTH) – “The value of all products and services generated increased by 1.8 percent. However, the labor cost of generating that small amount of added value increased by 7.4 percent. The difference between those two numbers is a drop in productivity of 5.2% over the entire quarter.

This is the largest quarterly drop in productivity since 1960 !

The Biden administration will blame the drop in productivity on a lack of material to produce the end product (ie. the COVID excuse). Which means employed people were sitting around waiting for goods to arrive and being less productive. There is a small amount of that which might be true. However, it is not the biggest factor, at least not on this scale. Keep in mind we are talking about both goods and services.

The more likely cause of such a massive decline in productivity is a genuine decline in demand. In the aggregate, consumers needed less goods and services. This likelihood aligns with the diminished and softened retail sales figures recently noted. It is a simple cause and effect. When gasoline, energy, and essential products like food cost more, consumers have less money for other stuff. Demand for the non-essential products drop.” (more)

When we look at the macro picture, things look a lot clearer than the financial pundits talk about.

After the March 2021 peak of savings rate (massive fed spending bill), sometime around June of 2021, the U.S. economy overall started to jam up. In May of 2021 the first round of massive inflation started, what the Fed and White House called “transitional”, but we noted it wasn’t.

Then, new home housing starts, and contracts for new homes yet to be built suddenly stopped; while at the same time (June/July 2021) new permits for construction dropped. From that moment forward prices for food, fuel and energy related products started a massive upward spike. Despite the Fed and administration “transitional” talking points, the prices continued to climb and inflation was growing month over month.

The middle class and working class started to really feel the inflationary pain in the second half of 2021. It was not the Delta variant driving this economic pain, it was inflation and the collapse of disposable incomes. By the time we go to November 2021, suddenly the low employment gains shocked the financial pundits. A few weeks later, we saw sales data from November go down, and retail hiring for the holiday season was non-existent.

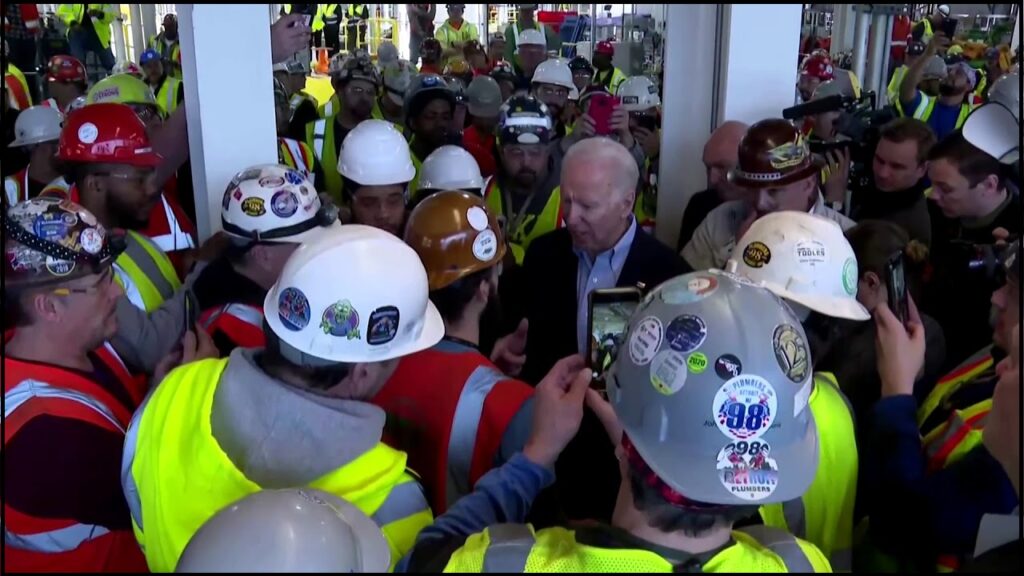

Take a look at the timeline in hindsight. At exactly the wrong time last year, September 2021, Joe Biden mandated vaccination for all U.S. workers. The economic data was sending signals that things were tenuous, but no one was paying attention. The already tenuous economy and labor pool (economists ignoring) was hit with an ultimatum of forced vaccination or get fired.

It’s not a single factor leading to this quits rate data. As you can see, there is a snowball effect inside the data. Wages earned, including any pay raises, have been chewed up by much higher inflation. When we look back upon this economy in a year, I am quite certain we will identify the inflection point as June of 2021. That’s when things peaked and started to go down.

Keep in mind, inflation has a big impact on job turnover. When people feel inflation, they look for pay raises. Larger employers are slower to respond to pay raises driven by worker needs, and many have very structured pay raise guidance.

Ex. if a worker needs a raise (immediate inflation driven), and the boss or organization is less responsive (structured pay raise schedule or performance review), the worker can get a faster pay raise by quitting their employer and going to work at a higher entry wage rate with another firm. If the job market is tight, the worker can make much more doing this. This is called job-jumping. In my opinion, this is a big factor right now.

So, what does the labor market look like in your town? What is going on in/around your community and local economy? Are you seeing a drop in spending habits overall for the people around you? The workforce hunkering down, forced to spend savings to survive and dealing with massive rising costs, will ultimately lead to less employment.

What do you see around you?