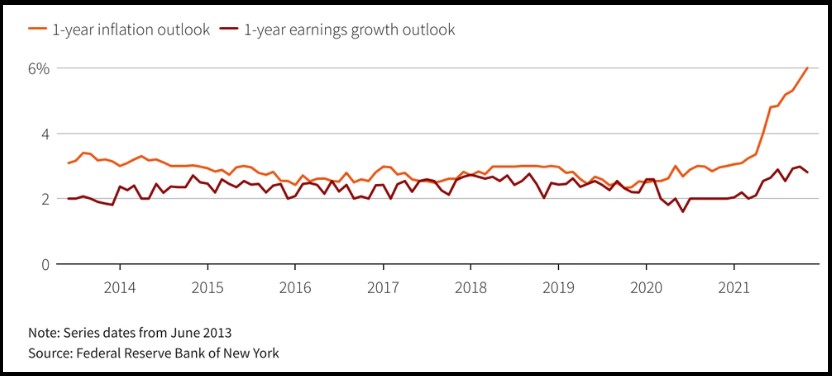

The New York Federal Reserve survey reflects the obvious. Consumers see staple food and energy price increases far outpacing any wage gains, and the outlook moving forward does not show signs of improvement.

The distance between the inflation line and the wage line is the intensity of the hurricane coming our way.

We are in this very weird place where the politically motivated Fed cannot stop purchasing debt created by legislative spending. At the same time, the political Fed is going to have to raise interest rates or we will enter an impossible spiral of policy caused inflation. There are three options: (1) stop buying debt; (2) increase interest rates; or (3) deploy some COVID mechanism to shut down people and hit the demand side.

Considering that Omicron didn’t work, and further panic pushing does not seem politically viable, that only leaves the two options of the Fed stops buying debt, and/or the Fed raises interest rates. Now, considering that these same political ideologues will not stop pushing the Build Back Better legislative agenda, that means the Fed cannot stop buying debt. That leaves one option remaining, increase interest rates.

Dec 13 (Reuters) – U.S. consumers’ short-term inflation expectations pushed higher in November and expectations for future earnings growth dropped, suggesting they anticipate price increases will outpace wage gains at an even faster rate in the near term, according to a survey released on Monday by the New York Federal Reserve.

Prices for food and other goods are rising at the fastest pace since 1982, according to data released by the Labor Department last week, posing political challenges for President Joe Biden’s administration and cementing expectations the Fed will raise interest rates next year. (read more)