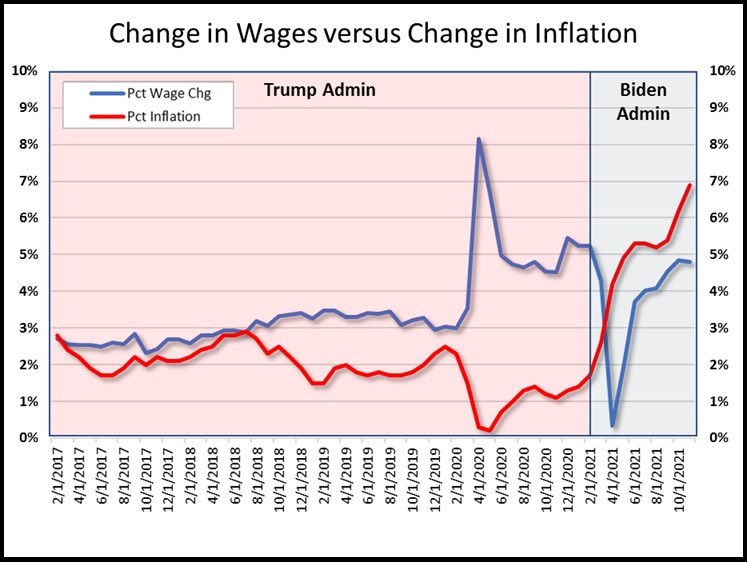

President Trump economic policy -vs- Joe Biden economic policy

When wages (blue line) are above inflation (red line) our income is growing, life is good and the working class has more disposable income to enjoy life. However, when wages (blue line) are lower than inflation (red line) our income is shrinking, life is a struggle and the working class has less disposable income to enjoy life.

♦ Point One – Nothing happens accidentally. The road to a “service-driven economy” is paved with a great disparity between financial classes. The wealth gap is directly related to the inability of the middle class to thrive.

♦ Point Two – There is nothing of value behind the obtuse term “service-driven economy.” The multinationals are paying for this administration, just like they paid the Obama administration; paying for economic policy that advances their interests. Congress goes along with the K-Street demands, because Wall Street is now the primary benefactor of legislative intent. Nothing about their effort is done with American interests in mind.

To go deep, keep reading.

♦ Point Three – Traditional Fascism was defined as an authoritarian government working hand-in-glove with corporations to achieve totalitarian objectives. A centralized autocratic government headed by a dictatorial leader, using severe economic and social regimentation, and forcible suppression of opposition.

That governmental system didn’t work in the long-term because the underlying principles driving free people rejected government authoritarianism. Fascist governments collapsed, and the corporate beneficiaries were nulled and scorned. Then along came a new approach to achieve the same objective.

The World Economic Forum (WEF) was created to use the same fundamental associations of government and corporations. Only this time the corporations organized to tell the governments what to do. The WEF was organized for multinational corporations to assemble and tell the various governments how to cooperate to achieve control.

Fascism is still the underlying premise, the WEF just flipped the internal dynamic.

The assembly of the massive multinational corporations, banks and finance offices now summon the government leaders to come to their assembly and receive their instructions. Some have called this corporatism. However, the relationship between government and multinationals is just fascism essentially reversed with the government doing what the corporations tell them to do.

…A massive multinational corporate conglomerate; telling a centralized autocratic government leader what to do; and using severe economic and social regimentation as a control mechanism; combined with forcible suppression of opposition by both the corporations and government.

Then we broke the glass, hit the emergency button and called Batman.

♦ Point Four – Donald J Trump was/is a walking red-pill; a “touchstone”: a visible, empirical test or criterion for determining the quality or genuineness of anything political. I have been deep enough into the network of the Deep State to understand the scale and scope of this enemy. To think that President Trump alone could carry the burden of correcting four decades of severe corruption of all things political, without simultaneously considering the scale of the financial opposition, is naive in the extreme.

POTUS Trump was disrupting the global order of things in order to protect and preserve the shrinking interests of the U.S. He was fighting, almost single-handed, at the threshold of the abyss. Our American interests, our MAGAnomic position, was/is essentially zero-sum. His DC and Wall-Street aligned opposition (writ large) needed to repel and retain the status-quo. They desperately wanted him removed so they could return to full economic control over the U.S, because it is the foundation of their power.

Without Donald J. Trump, these entities would still be operating in the shadows. With Donald J. Trump, we can clearly see who the real enemy is.

In these economic endeavors President Trump was disrupting decades of financial schemes established to use the U.S. as a host for their endeavors. President Trump was confronting multinational corporations and the global constructs of economic systems that were put in place to the detriment of the host (USA) ie YOU. There are trillions at stake; it is all about the economics; everything else is chaff and countermeasures.

In most of the modern post-war industrial era (1950-1980), banking was a boring job and only slide rule bean counters and actuarial accountants moved into that sector of the workforce. Most people don’t like math – these were not exciting jobs. Inside the most boring division of a boring banking industry were the bond departments within the larger bank and finance companies.

The excitement was in the actual economy of Main Street business. The giants of industry created businesses, built things, manufactured products, created innovation and originated internal domestic wealth in a fast-paced real economy. Natural peaks and economic valleys, as the GDP expanded and contracted, based on internal economic factors of labor, energy, monetary policy and regulation.

Main Street generated the pool of political candidates, because the legislative conduct of politicians had more impact on Main Street. Simply, the business agents had a vested interest in political determinations.

Political candidates courted industrialists, business owners, and capitalist giants to support them. As a consequence, Main Street USA was in control of DC outcomes.

Despite the liberal talking points to the contrary, this relationship was a natural synergy of business interests and political influence. It just made sense that way, and the grown-ups were generally in charge of it.

♦ Commercial banks courted businesses because bankers needed deposits. Without deposits banks could not generate loans; without loans banks could not generate profits…. and so it was. By rule, only 10 percent of a commercial bank’s income could stem from securities.

♦ Commercial banks courted businesses because bankers needed deposits. Without deposits banks could not generate loans; without loans banks could not generate profits…. and so it was. By rule, only 10 percent of a commercial bank’s income could stem from securities.

One exception to this 10% rule was that commercial banks could underwrite government-issued bonds. Investment banks (the bond division) were entirely separate entities. The Glass-Steagall banking laws of 1932 kept it that way.

However, mid 1970’s bank regulators began issuing Glass–Steagall interpretations -that were upheld by courts- and permitted banks and their affiliates to engage in an increasing variety and amount of securities activities. After years of continual erosion of the Glass-Steagall firewall, eventually it disappeared.

This became the origin of the slow-motion explosion of investment banking. If you look back historically from today toward 1980 (ish), what you will find is this is also the ultimate fork where economic globalism began overtaking economic nationalism.

Banks could now make money, much more money, from investment divisions issuing paper financial transactions, not necessarily dependent on actual physical assets. The transactions grew exponentially.

The bond market portion ultimately led to the ’07/’08 housing collapse, and derivative trading (collateralized debt obligations or CDO’s) generated trillions of paper dollars. Long before the ’08 collapse, business schools in 1980 began calling this the second economy (a false economy, or the invisible economy).

The second economy, which ultimately became the global economy, is also the Wall Street investment economy. Two divergent economies: Wall Street (paper), and Main Street (real).

There is no real property, real capital, real tangible assets in the Wall Street economy. The false economy is based on trades and financial transactions, essentially opinions. Paper shifts, and buys and sells based on predictions and bets (derivatives).

Ford Motor Company (only chosen as a commonly known entity) has a stock valuation based on their actual company performance in the market of manufacturing and consumer purchasing of their product. However, there can be thousands of financial instruments wagering on the actual outcome of their performance.

There are two initial bets on these outcomes that form the basis for Hedge fund activity. Bet ‘A’ that Ford hits a profit number, or bet ‘B’ that they don’t. There are financial instruments created to place each wager. [The wagers form the derivatives] But it doesn’t stop there.

Additionally, more financial products are created that bet on the outcomes of the A/B bets. A secondary financial product might find two sides betting on both A outcome and B outcome.

Party C bets the “A” bet is accurate, and party D bets against the A bet. Party E bets the “B” bet is accurate, and party F bets against the B. If it stopped there, we would only have six total participants. But it doesn’t stop there, it goes on and on and on…

The outcome of the bets forms the basis for the tenuous investment markets. The important part to understand is that the investment funds are not necessarily attached to the original company stock, they are now attached to the outcome of bet(s). Hence, an inherent disconnect is created.

Subsequently, if the actual stock doesn’t meet it’s expected P-n-L outcome (if the company actually doesn’t do well), and if the financial investment was betting against the outcome, the value of the investment actually goes up. The company performance and the investment bets on the outcome of that performance are two entirely different aspects of the stock market. [Hence two metrics.]

Insurance products create an even larger subdivision within the false economy as hedgers wagered on negative outcomes. The money wagered is exponential – some say more than a quadrillion currently floats.

♦ Now you realize, in hindsight, there had to be a point where the value of the second economy (Wall Street) surpassed the value of the first economy (Main Street). Investments, and the bets therein, needed to expand outside of the USA. Hence, globalist investing.

However, a second more consequential aspect happened simultaneously.

The politicians became more valuable to the Wall Street team than the Main Street team; and Wall Street had deeper pockets because their economy was now larger.

As a consequence, Wall Street started funding political candidates and asking for legislation that benefited their interests.

When Main Street was purchasing the legislative influence the outcomes were beneficial to Main Street, and by direct attachment those outcomes also benefited the average American inside the real economy.

When Wall Street began purchasing the legislative influence, the outcomes therein became beneficial to Wall Street. Those benefits are detached from improving the livelihoods of main street Americans because the benefits are “global” needs. Global financial interests, investment interests, are now the primary filter through which the DC legislative outcomes are considered.

♦ Most people think when they vote for a federal politician -a House or Senate representative- they are voting for a person who will go to Washington DC and write or enact legislation. This is the old-fashioned “schoolhouse rock” perspective based on decades past. There is not a single person in congress writing legislation or laws.

In modern politics, not a single member of the House of Representatives or Senator writes a law, or puts pen to paper to write out a legislative construct. This simply doesn’t happen.

Over the past several decades, a system of constructing legislation has taken over Washington DC that more resembles a business operation than a legislative body. Here’s how it works right now.

Corporations (special interest group) write the legislation. Lobbyists take the law and go find politician(s) to support it. Politicians get support from their peers using tenure and status etc. Eventually, if things go according to norm, the legislation gets a vote.

Corporations (special interest group) write the legislation. Lobbyists take the law and go find politician(s) to support it. Politicians get support from their peers using tenure and status etc. Eventually, if things go according to norm, the legislation gets a vote.

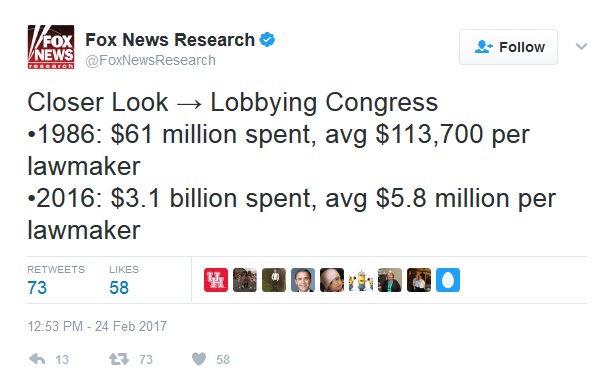

Within every step of the process there are expense account lunches, dinners, trips, venue tickets and a host of other customary financial way-points to generate/leverage a successful outcome. The amount of money spent is proportional to the benefit derived from the outcome.

The important part to remember is that the origination of the entire process is EXTERNAL to congress.

Congress does not write laws or legislation, special interest groups do. Lobbyists are paid, some very well paid, to get politicians to go along with the need of the legislative group.

When you are voting for a Congressional Rep or a U.S. Senator, you are not voting for a person who will write laws. Your rep only votes on legislation to approve or disapprove of constructs that are written by outside groups and sold to them through lobbyists who work for those outside groups.

While all of this is happening, the same outside groups who write the laws are providing money for the campaigns of the politicians they need to pass them. This construct sets up the quid-pro-quo of influence, although much of it is fraught with plausible deniability.

This is the way legislation is created.

If your frame of reference is not established in this basic understanding, you can often fall into the trap of viewing a politician, or political vote, through a false prism. The modern origin of all legislative constructs is not within congress.

Now, ask yourself this important question….

…. Who is writing the details of the Build Back Better bill?

Joe Biden has no idea, and that my friends is entirely by design.