“If you build it, they will come”…

It would appear there is a great deal of interest in the newly announced Trump Media and Technology Group as shares for the special media acquisition company, DWAC, the firm merging with Trump to lead the fundraising have skyrocketed after the announcement.

Beginning the day around $10/share, the value of DWAC jumped to a session high $51/share, as more than 412 million shares have been traded. Buy orders outpace sell orders by 3 to 1. [Current CNBC ticker here] DWAC is by far the most active stock as MAGA retail investors climb on board the opportunity to challenge Big Tech with Trump social media. They even tried numerous times to stop trading…. but the people kept coming, and coming, and coming….

(CNBC) – […] DWAC’s stock surged as much as 400% to $51 per share Thursday after trading was halted multiple times due to volatility.

Digital World Acquisition was the single most actively traded stock on the Fidelity platform Thursday, and was by far the most traded name on the consolidated tape of New York Stock Exchange and Nasdaq listings.

Buy orders for DWAC — a so-called special purpose acquisition company set up to raise capital in the public markets to purchase private firms — outnumbered sell orders by nearly 3-to-1 on Fidelity’s platform. By afternoon trading, more than 360 million shares of DWAC had already changed hands, according to FactSet.

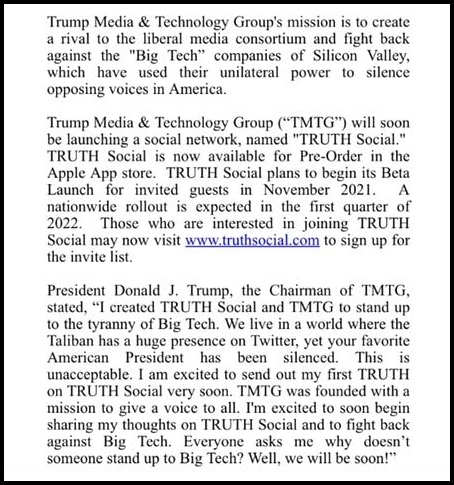

[…] In a press release Wednesday night, Trump’s new company, Trump Media & Technology Group, said it and DWAC “have entered into a definitive merger agreement, providing for a business combination that will result in Trump Media & Technology Group becoming a publicly listed company, subject to regulatory and stockholder approval.” Trump also said he would roll out a platform called “TRUTH Social,” which he claimed will “stand up to the tyranny of Big Tech.” (read more)