Raw material foodstuff price contracts are expiring, and the new purchasing prices will be significantly higher than current. As these contracts refresh, the new higher prices immediately enter the food supply chain. CTH has been warning readers to stock up on non-perishable items as this next wave of food price increases is going to be much bigger than even the prior 8%/avg jumps; and there is absolutely no end in sight.

Also, as more large municipal regions (megalopolis metropolitan areas like New York City and Los Angeles) begin enforcing a vaccine passport to eat in restaurants, the demand for meals at home will remain high. Supermarkets again will fill the void in the diet of consumers who choose to remain at home instead of eating out.

Also, as more large municipal regions (megalopolis metropolitan areas like New York City and Los Angeles) begin enforcing a vaccine passport to eat in restaurants, the demand for meals at home will remain high. Supermarkets again will fill the void in the diet of consumers who choose to remain at home instead of eating out.

The current demand on retail food products is likely visible to you in the form of bare shelves and minimal inventory.

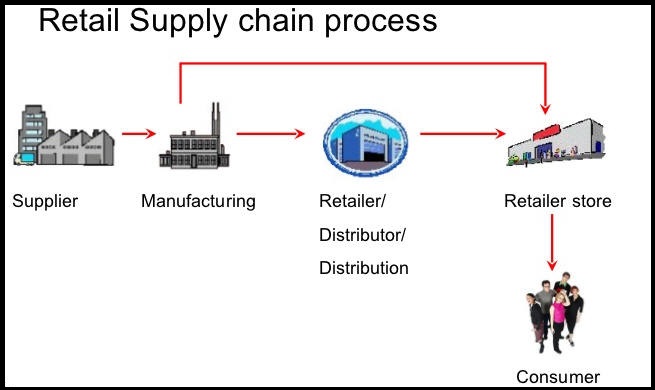

Grocery retailers operate on paper thin gross profit margins and rely on fast turns of multiple penny profit items to add up to net profit income. Technology has helped modern grocery supply chains to be very thin.

An inventory shortage arises when demand on the retail grocery industry spikes – which is what we have seen with COVID impacts as alternative food options were forcibly closed or pressured to reduced capacity.

Conagra is one of the large food conglomerates with control over products from field to fork. Recently, Conagra executives announced they expect food prices to climb even higher due to all of the aforementioned impacts, along with large price increases in fuel and energy.

Wall Street Journal […] Conagra said Thursday it expects gross inflation—which doesn’t take into account hedging—to be about 11% for fiscal 2022, versus its earlier estimate of 9%. The company plans to continue adjusting prices and cutting costs, and said its prices likely will rise 4% or more during the current fiscal year.

Executives said they expect ongoing strong demand, price increases and cost-cutting measures to offset the higher costs. So far shoppers are largely sticking with Conagra’s brands despite higher costs, they said, though the bulk of the company’s price increases have only recently begun to show up on U.S. supermarket shelves. (read more)

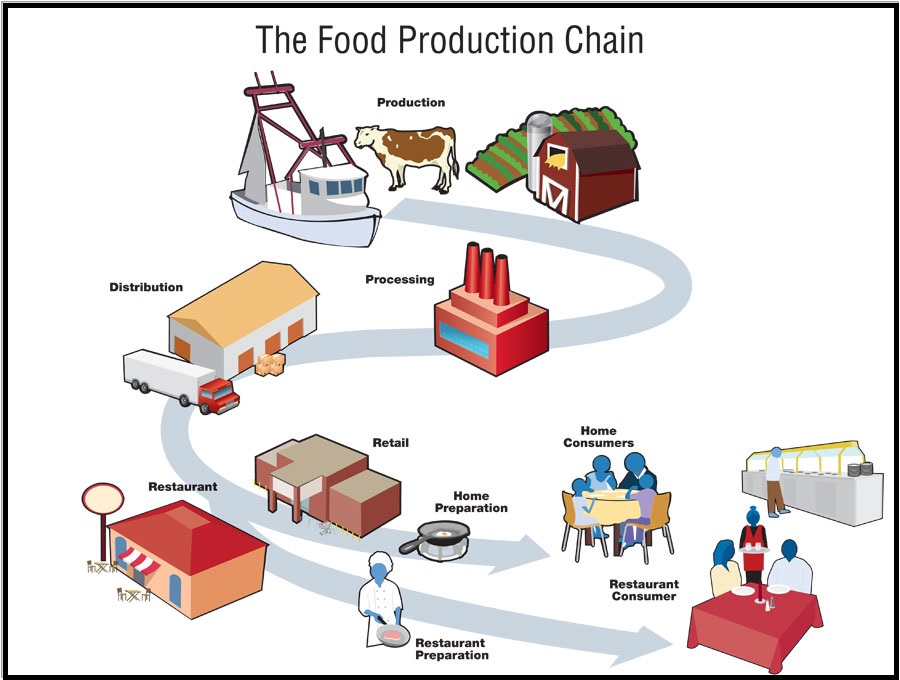

[Note – Fiscal year 2022 began October 1, 2021.] Wheat, corn and soybeans are the foundation of the U.S. food supply. They are primarily used as ingredients in processed foods, oils, and are fed to the cattle, hogs, and poultry that supply meat and eggs for the American diet. When those grain harvests go up in price, the downstream increase in price is far reaching.

Processed foods and shelf stable foods have a deeper inventory than fresh foods. The turns on that shelf-stable inventory take longer, and as a consequence, it takes longer for the price increases to show up. As contracts renew and new inventory flows into the supply chain, the total supply chain price increases -including fuel and transportation costs- are going to hit hard. They are going to hit even harder than the last few months as the new processed inventory carries a higher cost.

Keep in mind, skyrocketing prices at the grocery store are predictable based almost entirely on Joe Biden’s pro-Wall Street and Multinational Corporation policies. Main Street is getting hammered, and the working class is suffering as a direct result. The administrations’ specific accountability for these outcomes is why the Biden team is trying to distract and blame COVID-19 for supply chain issues. However, it is not COVID driving the prices, it’s Joe Biden’s policies that benefit multinationals. {Go Deep}

Prior to COVID-19, China and the EU were devaluing their currency; the value of the dollar increased. This was great for products we import (durable goods, TV’s, electronics, etc) however, the high dollar value made exports from the U.S. more expensive.

U.S. companies who relied on exports (lots of agricultural industries and raw materials) took a hit from higher export prices. Less raw material including food was being purchased by overseas manufacturing groups. However, and this part is really interesting, their lack of purchasing made U.S. companies more dependent on domestic sales for income. With less raw material foodstuff being exported, there was more product available in the U.S for domestic purchase…. this dynamic led to a predictable outcome for those with common sense, lower food prices for U.S. consumers.

That was under President Trump policy. However, Joe Biden flipped this dynamic and dropped the value of the dollar with massive -far more than needed- stimulus and bailout spending. The monetary policy that pumps money into into the U.S. economy via COVID bailouts and ever-increasing federal spending drops the value of the dollar and makes the dependency state worse.

With a Democrat Congress and progressive FED pumping money into the U.S. system and expanding the deficit, the dollar value plummets. Now the value of the Chinese and EU currency increases. This means it costs more to import products, and that is the primary driver of price increases in durable consumer goods.

Simultaneously, a lower dollar value means cheaper exports for the multinationals (Big AG and raw materials). China, SE Asia and even the EU purchase U.S. raw materials at a lower price with their higher valued currencies.

All of those exported food sales -controlled by multinational corporations- mean less raw material in the U.S. which drives up prices for U.S. consumers. It is a perfect storm. Higher costs for imported goods and much higher costs for domestic goods (food). Combine this dynamic with massive increases in energy costs from ideological climate policy, and that’s fuel on the fire of inflation.

The retail consumer supply chain for manufactured and processed food products includes bulk storage to compensate for seasonality. There are over 800 commercial and public warehouses in the continental 48 states that store frozen products (2020 data). The previously processed food price increases are currently reflected on store shelves (already hurting). However, the coming processed processed food price increases will be much, much higher. We will see even higher prices on processed foods in the supermarket.

This is terrible for wage earners in the U.S. who are now seeing no wage growth and higher prices. Real wages are decreasing by the fastest rate in decades. We are now in a downward spiral where your paycheck buys less. As a result, consumer middle-class spending contracts. Eventually, this means housing prices drop because people cannot afford higher mortgage payments.

Gasoline costs more (+50%), food costs more (+10% at a minimum) and as a result, real wages drop; disposable income is lost. Ultimately this is the cause of Stagflation. A stagnant economy and inflation. None of this is caused by COVID-19. All of this is caused by economic policy and monetary policy sold under the guise of COVID-19.

This inflationary period will not stall out until the U.S. economy can recover from the massive amount of federal spending. If the spending continues, the dollar continues to be weak, as a result the inflationary period continues. It is a spiral that can only be stopped if the policies are reversed…. and the only way to stop these insane policies is to get rid of the Wall Street Democrats and Republicans who are constructing them.