The Bureau of Labor Statistics (BLS) released the third quarter review of average weekly wages [Main Data Here]. The results of the year-over-year comparison should alarm everyone. This is a very serious data point that likely means we are in a recession, it just has not been quantified yet.

By now, everyone knows the term “stagflation”, which means a stagnant economy and large inflation (price increases), the easiest comparison is Jimmy Carter economic program in the 1970’s. However, let me assure you what this latest BLS release foretells is not that. This is far more serious than stagflation. I am not an alarmist, but I am encouraging everyone to take this economic data seriously.

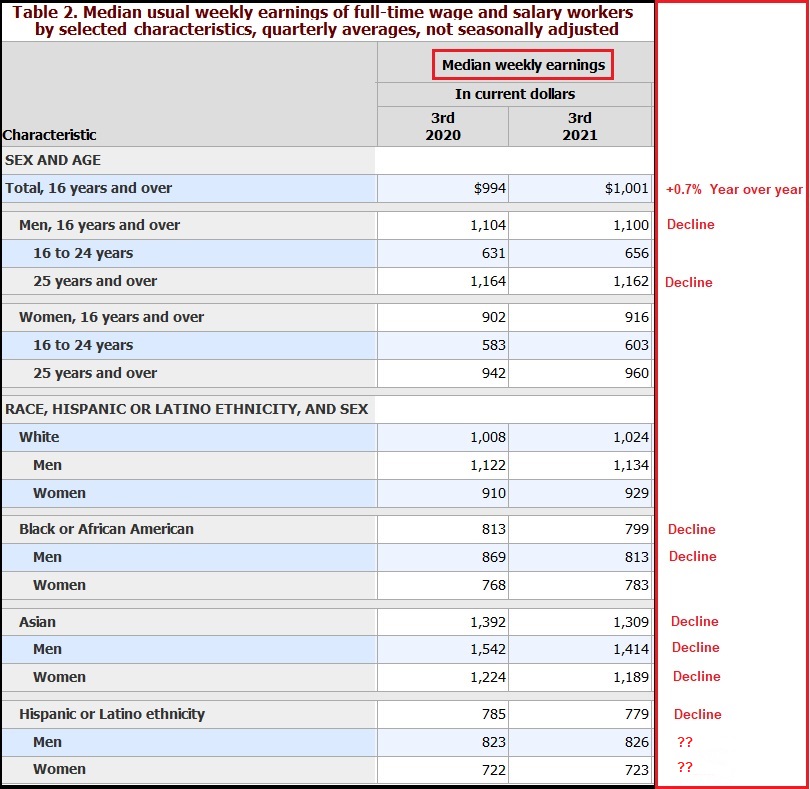

In this graphic I have modified the spread sheet to focus attention on the part that really matters. [Original Data Table 2 Here] What you are seeing here is a comparison of weekly wages for the third quarter (July, Aug, Sept) of this year, compared to the weekly average wages in 2020:

Weekly wages went up a sum total of seven bucks [$7/1,000 = 0.7%] year over year. THAT is ridiculously low. However, worse yet look at all the categories of workers who saw an actual decline in wages. This is not a decline in wage value, this is an actual decline in net wages earned. WAGES HAVE DROPPED !

This is not only saying wages are failing to keep up with inflation, that part is beyond obvious, the data shows actual declines in wages for full time workers. This is far more concerning, check that…. this is four alarm fire – running around the neighborhood naked and panicked level concerning… when you take actual declines in wages and factor in the September inflation numbers [Main Data Here].

Avg. weekly wages can drop if massive numbers of people enter the workforce in specific low paying jobs. However, this is not that, because employment growth has been weak and minimal at best; missing all expectations to the downside. The data on wages declining year-over-year is a genuine decrease in average wages earned.

♦ Now Factor Inflation – The inflation rate is stunning [Table 7 data Here]. Examples: Beef costs 20% more (year over year). Bacon costs 20% more. Eggs cost 12% more. Peanut butter costs 10% more. Home heating oil costs 42% more. Unleaded gasoline costs 43% more. Natural gas costs 20% more. Used cars are 24% more. The list goes on (SEE HERE).

I don’t have to tell you this, you can see it in your receipt at the grocery store and in the gas pumps at your local convenient store. But the point is that massive inflation is eating our paychecks and the inflation is getting worse, not better. Prices continue to skyrocket and the dollar continues to be weakened.

I don’t have to tell you this, you can see it in your receipt at the grocery store and in the gas pumps at your local convenient store. But the point is that massive inflation is eating our paychecks and the inflation is getting worse, not better. Prices continue to skyrocket and the dollar continues to be weakened.

When you overlay the inflation, massive price increases in critical goods that middle-class Americans purchase every day; and when you overlay the massive energy cost increases and the cost of home heating oil this winter; and THEN you consider the reality that wages are actually lower than a year ago, well, it is a perfect storm.

CTH previously stated that from a macro perspective home values peaked in the last two weeks of May and first two weeks of June. Other than institutional investors buying real estate because they need to hold a tangible asset; and some regions where home values are driven by COVID migration patterns; we do not see blue collar working class families purchasing homes, replacement vehicles or expensive durable goods.

Disposable income has been crushed in the past six months. Now we are seeing data to quantify just how bad the issue is. With wages declining and prices increasing, the likelihood the 3rd quarter GDP (July, Aug, Sept) will show a contraction is very high. [Note Q3 GDP release is the first Friday in November]

This is beyond stagflation, because the economy is not only stagnant with inflation high, but also because actual weekly wages have dropped. Overall Main Street consumer purchasing is now focused on staple goods like housing, food, fuel and energy costs.

Some have speculated that a “Great Reset” includes the collapse of the economy to such an extent that government will be the only source of financial stability. I’m not sure if it will get to that level, but this latest BLS data release showing a contraction in wages for the blue collar bread winners is very alarming.

What is it like in your neighborhood? What types of prices for gasoline and foodstuffs are you encountering?