The latest measure of consumer confidence [Data Here] reflects a continued trend, and the index drops well below expectations. The Consumer Confidence Survey is a monthly report detailing “consumer attitude, buying intentions, vacation plans and consumer expectation for inflation, stock prices and interest rates.”

The index now stands at 113, a drop from last month when it was 125. The decline in confidence is an outcome of workers and consumers feeling the impact of massive inflation from Joe Biden economic and monetary policies. With gas and food prices climbing rapidly, it should not be a shock to see consumer confidence begin dropping; however, the financial analysts were caught off guard by the unexpected size of the drop.

The index now stands at 113, a drop from last month when it was 125. The decline in confidence is an outcome of workers and consumers feeling the impact of massive inflation from Joe Biden economic and monetary policies. With gas and food prices climbing rapidly, it should not be a shock to see consumer confidence begin dropping; however, the financial analysts were caught off guard by the unexpected size of the drop.

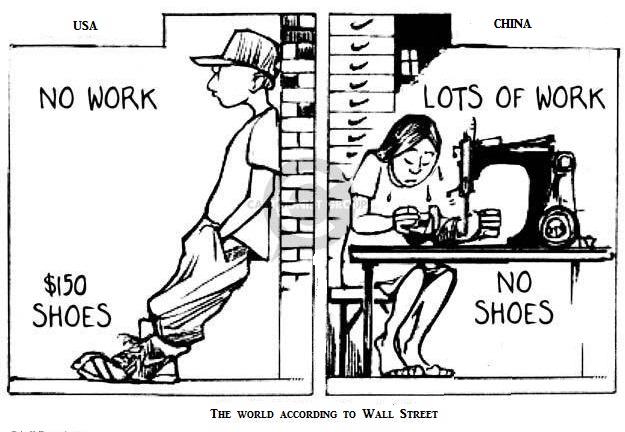

According to Marketwatch, “Economists polled by The Wall Street Journal had forecast a reading of 123.1”, a drop to 113 is a much more severe change in consumer confidence than expected. The economists who get this stuff wrong repeatedly are inside the echo-chamber of Wall Street and the financial class. There is a disconnect between those analysts and the real economy on Main Street; that’s why they are always surprised.

Inflation is eating at the middle-class on serious checkbook issues. All of the COVID stimulus and relief funds targeting the working class are being eaten up by the inflation those policies create. It is a self-fulfilling prophecy. As we have noted in prior data, consumer spending for durable goods has completely dropped.

“Spending intentions for homes, autos, and major appliances all cooled somewhat; however, the percentage of consumers intending to take a vacation in the next six months continued to climb.” (link)

Unfortunately, this trend will likely continue as ‘real wages‘ (wage growth minus inflation) continue to drop.

Energy costs are high and climbing; food costs are high and climbing; gasoline costs are high and climbing… as this continues it has a negative impact on all types of consumer spending, including durable goods and housing. This is Obamanomics all over again, only now it is JoeBamanomics.