Article by Fred Imbert and Thomas Franck in "CNBC Business":

Stocks slumped on Friday as shares of Amazon led the major indexes lower on the month’s first day of trading following its first-quarter results.

The Dow Jones Industrial Average fell 400 points, about 1.6%, as Goldman Sachs and UnitedHealth each fell more than 2.75%. The S&P 500 dropped 1.6% with consumer discretionary and energy stocks leading the broad market index down. The Nasdaq Composite dropped 1.5% as a host of big-tech names fell in morning trading.

Tech titan Amazon led declining stocks on the week’s final day of trading with shares down 5.5% after announcing plans to spend all its second-quarter profits on its coronavirus response. The e-commerce behemoth also posted a first-quarter profit that missed analyst expectations.

Apple reported quarterly earnings that topped analyst expectations, but its revenue growth remained flat on a year-over-year basis.

It also did not offer guidance for the quarter ending in June amid

uncertainty over the coronavirus outbreak. The tech giant’s stock gained

1.3%.

Both Apple and Amazon are among the companies that led the S&P 500′s comeback from the late-March lows and were two of the best performers in April. Amazon rallied nearly 27% in April while Apple jumped 15.3%.

“A historically strong April in markets ended on a down note as more soft economic data offset fading optimism for coronavirus treatments while earnings were mixed,” wrote Tom Essaye of the Sevens Report. Stocks “are sharply lower mostly on continuation from yesterday’s selling as markets digest the recent rally, although AAPL & AMZN earnings were mildly disappointing.”

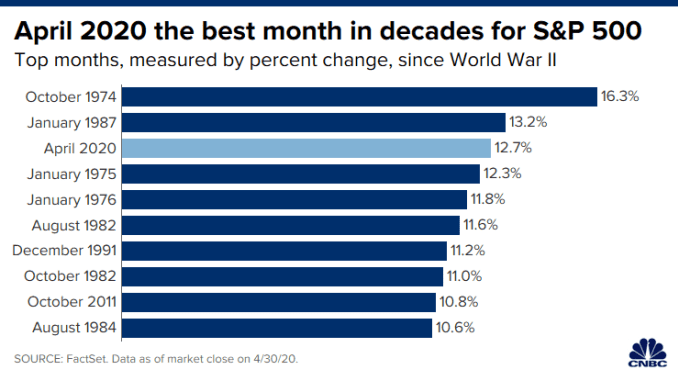

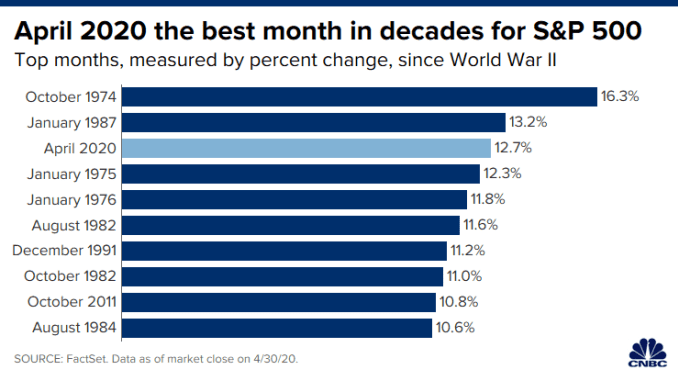

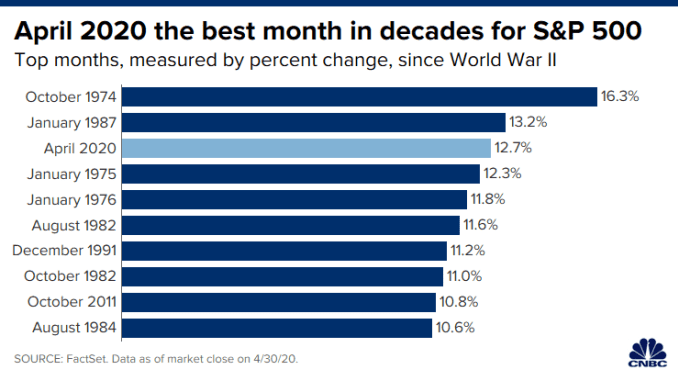

Wall Street was coming off its biggest monthly surge in over 30 years, with the S&P 500 gaining 12.7% while the Dow advanced 11.1%. It was the third-biggest monthly gain for the S&P 500 since World War II. The Dow had its fourth-largest post-war monthly rally and its best month in 33 years.

The Nasdaq Composite closed 15.5% higher for April, logging in its biggest one-month gain since June 2000.

Those gains were partly driven by hopes of reopening the economy sooner than expected.

Stocks that would benefit most from that reopening jumped at the end of March, including Carnival Corp, MGM Resorts and Kohl’s. However, those shares all fell Friday, down 4%, 6% and 1.1%, respectively.

Hope for a potential treatment for the coronavirus has also helped the market make a comeback. Earlier in the week, Gilead Sciences said a study of its remdesivir drug conducted by the National Institute of Allergy and Infectious Diseases met its primary endpoint.

The number of new infections around the world has also fallen in recent weeks, leading some countries and U.S. states to slowly reopen their economies.

But Phillip Colmar and Santiago Espinosa, strategists at MRB Partners, urged investors to remain cautious.

“The sharp relief rally in equities has now moved ahead of underlying fundamentals, leaving room for near-term disappointments,” they said in a note to clients. “Many authorities are looking to reopen their economies but doing so safely and to near previous output levels will require a series of medical breakthroughs and widespread distribution of the treatment.”

More than 3.2 million virus cases have been confirmed globally, according to Johns Hopkins University, with over 1 million infections in the U.S. alone.

https://www.cnbc.com/2020/04/30/stock-market-futures-open-to-close-news.html

Both Apple and Amazon are among the companies that led the S&P 500′s comeback from the late-March lows and were two of the best performers in April. Amazon rallied nearly 27% in April while Apple jumped 15.3%.

“A historically strong April in markets ended on a down note as more soft economic data offset fading optimism for coronavirus treatments while earnings were mixed,” wrote Tom Essaye of the Sevens Report. Stocks “are sharply lower mostly on continuation from yesterday’s selling as markets digest the recent rally, although AAPL & AMZN earnings were mildly disappointing.”

Wall Street was coming off its biggest monthly surge in over 30 years, with the S&P 500 gaining 12.7% while the Dow advanced 11.1%. It was the third-biggest monthly gain for the S&P 500 since World War II. The Dow had its fourth-largest post-war monthly rally and its best month in 33 years.

The Nasdaq Composite closed 15.5% higher for April, logging in its biggest one-month gain since June 2000.

Those gains were partly driven by hopes of reopening the economy sooner than expected.

Stocks that would benefit most from that reopening jumped at the end of March, including Carnival Corp, MGM Resorts and Kohl’s. However, those shares all fell Friday, down 4%, 6% and 1.1%, respectively.

Hope for a potential treatment for the coronavirus has also helped the market make a comeback. Earlier in the week, Gilead Sciences said a study of its remdesivir drug conducted by the National Institute of Allergy and Infectious Diseases met its primary endpoint.

The number of new infections around the world has also fallen in recent weeks, leading some countries and U.S. states to slowly reopen their economies.

But Phillip Colmar and Santiago Espinosa, strategists at MRB Partners, urged investors to remain cautious.

“The sharp relief rally in equities has now moved ahead of underlying fundamentals, leaving room for near-term disappointments,” they said in a note to clients. “Many authorities are looking to reopen their economies but doing so safely and to near previous output levels will require a series of medical breakthroughs and widespread distribution of the treatment.”

More than 3.2 million virus cases have been confirmed globally, according to Johns Hopkins University, with over 1 million infections in the U.S. alone.

https://www.cnbc.com/2020/04/30/stock-market-futures-open-to-close-news.html