Article by Yun Li and Eustance Huang in "CNBC Markets":

Stocks tumbled on Monday as investors braced for the economic fallout from the spreading coronavirus, while a shocking all-out oil price war added to the anxiety.

The Dow Jones Industrial Average tanked more than 1,800 points at the open. The S&P 500 dropped 7%. The massive sell-off triggered key market circuit breakers in morning trading. Trading was halted for 15 minutes at 9:35 a.m. ET.

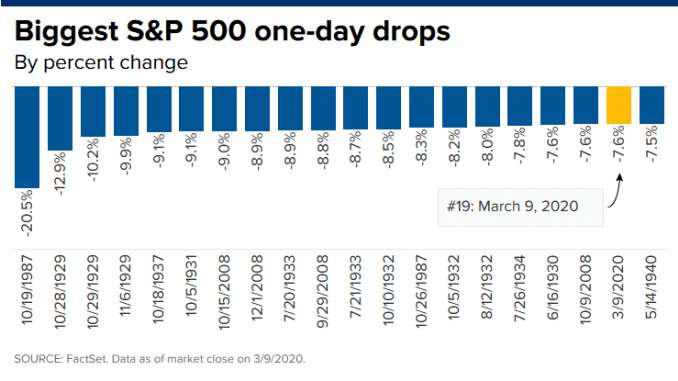

The sharp declines followed a roller-coaster week that saw the S&P 500 swing up or down more than 2.5% for four days straight. While Monday’s drop is poised to be significant, it still wouldn’t crack the 20 worst days in the S&P 500.

Investors

continued to seek safer assets amid additional fears that the

coronavirus will disrupt global supply chains and tip the economy into a

recession. The yield on the benchmark 10-year Treasury note dropped below 0.5% for the first time ever, while the 30-year rate breached 1%.

Investors

continued to seek safer assets amid additional fears that the

coronavirus will disrupt global supply chains and tip the economy into a

recession. The yield on the benchmark 10-year Treasury note dropped below 0.5% for the first time ever, while the 30-year rate breached 1%.

Saudi Arabia on Saturday slashed official crude selling prices

for April, in a sudden U-turn from previous attempts to support the oil

market as the coronavirus hammers global demand. The move came after

OPEC talks collapsed Friday, prompting some strategists to see oil

prices crater to $20 this year.

“Crude has become a bigger problem

for markets than the coronavirus,” Adam Crisafulli, founder of Vital

Knowledge, said Sunday. “It will be virtually impossible for the

[S&P 500] to sustainably bounce if Brent continues to crater,” he

added.

International benchmark Brent crude futures plummeted 29.07% to $32.11 per barrel after dropping 30% earlier. U.S. West Texas Intermediate crude futures dropped 30.98% to $28.49 per barrel, on track for its worst day since 1991. The Energy Select Sector SPDR Fund (XLE), which tracks the energy sector, tumbled 15%.

Bank

stocks are getting smashed as lower yields put pressure on their

margins, while an oil crash could cause energy companies to default on

their obligations. JPMorgan plunged more than 11%.

Investors have

already been on edge about the coronavirus outbreak that caused major

stock averages to tumble into correction territory. As of Sunday, global

cases of the infection have climbed to more than 109,000

with at least 3,801 deaths around the world. The situation is also

worsening in the U.S. with New York, California and Oregon all declaring

a state of emergency.

“The idea that lower gasoline prices is

going to put more cash in workers’ pockets and give consumer spending

and the economy a boost doesn’t seem to cushion the blow for stock

market investors,” Chris Rupkey, MUFG Union Bank’s chief financial

economist, said in a note Sunday. “They want out. Big time. The sky is

falling. Get out, get out while you can. Wall Street’s woes have to

eventually hit Main Street’s economy hard.”

Gold, another

safe-haven asset, crossed $1,700 an ounce, hitting its highest level

since Dec. 2012. Meanwhile, copper prices hit a more than three-year low

of $2.46. Copper is seen as a barometer of broad economic demand given

its applications in electrical equipment and manufacturing.

The Federal Reserve announced

an emergency rate cut last week to combat the economic impact from the

virus, its first such move since the financial crisis. President Donald

Trump on Friday signed a sweeping spending bill of an $8.3 billion package to aid medical research.

The New York Fed said Monday it will increase the amount of money

it is offering to banks for their short-term funding needs. To make

sure the funding, or repo, markets are working properly, the central

bank said it will up the amount it offers in overnight operations from

$100 billion to $150 billion through Thursday.

Traders expect the

central bank to slash rates by three-quarters of a percentage point at

its upcoming March meeting. Chances for a full percentage point cut this

month were at 29.2%, according to the CME FedWatch tracker.The iShares High Yield Corporate Bond ETF (HYG)

fell 4.5%, on concerns that a oil price crash will cause many small

energy companies to default, hitting the high yield credit market that

they’ve become so a large part of.